On July 1, 20X2, Alan Enterprises merged with Cherry Corporation through an exchange of stock and subsequent

Question:

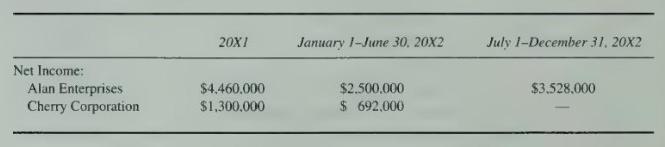

On July 1, 20X2, Alan Enterprises merged with Cherry Corporation through an exchange of stock and subsequent liquidation of Cherry. Alan issued 200,000 shares of its stock to effect the combination. The book values of Cherry's assets and liabilities were equal to their fair values at the date of combination, and the value of the shares exchanged was equal to the book value of Cherry Corporation. Information relating to income for the companies is as follows:

Alan Enterprises had 1,000,000 shares of stock outstanding prior to the combination.

\section*{Required}

Compute the net income and earnings-per-share amounts that would be reported in Alan's 20X2 comparative income statements for both \(20 \mathrm{X} 1\) and \(20 \mathrm{X} 2\), assuming the business combination is treated as a pooling of interests.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King