On June 30, 20X1, Punt Corporation acquired 70% of the outstanding common shares of Slide Ltd. for

Question:

Common shares.....................$2,900,000

Retained earnings.......................540,000

.................................................$3,440,000

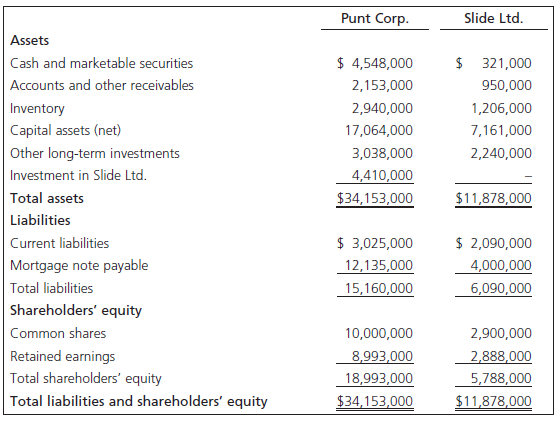

Statements of financial position at June 30, 20X5, are as follows:

Additional Information

1. Slide Ltd. had income of $1,460,000 for the year ended June 30, 20X5. Dividends of $480,000 were declared during the fiscal year but were not paid until August 12, 20X5.

2. Slide Ltd. has had an average inventory turnover of four times per year over the past decade.

3. The capital assets that were overvalued on the date of acquisition had a remaining useful life of 20 years.

4. Slide sold goods to Punt during the year ended June 30, 20X4, at a gross profit margin of 25%. The opening inventory of Punt at July 1, 20X4, included items purchased from Slide in the amount of $160,000. There were no sales from Slide to Punt during the year ended June 30, 20X5.

5. Punt sold goods to Slide Ltd. during the current fiscal year at a gross profit margin of 30%. Of the $750,000 of sales, goods worth $200,000 were in Slide€™s closing inventory at June 30, 20X5. None of these intercompany sales still in inventory had been paid for at the fiscal year-end.

6. Both companies follow the straight-line method for depreciating capital assets.

7. The controller of Punt has informed you that, to date, there has been no impairment in goodwill.

Required

Prepare the consolidated statement of financial position for Punt Corporation and its subsidiary, Slide Ltd., at June 30, 20X5.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay