On May 6, 20X1. Roto Corporation acquired all the assets and liabilities of Spice Company by issuing

Question:

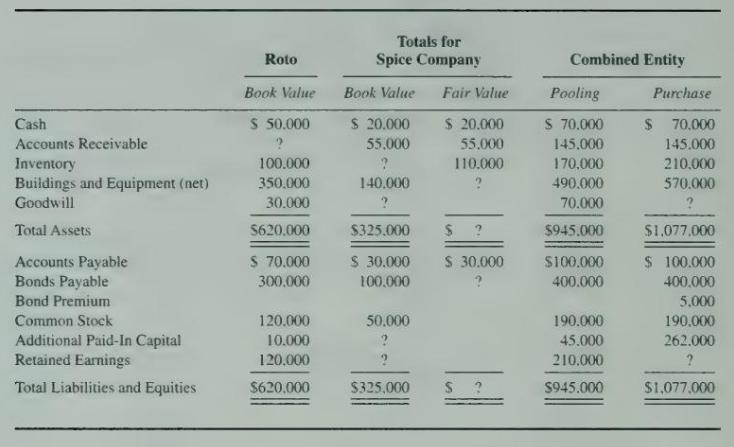

On May 6, 20X1. Roto Corporation acquired all the assets and liabilities of Spice Company by issuing its \(\$ 5\) par voting common stock in exchange. Spice 's \(\$ 10\) par value common shares had a market price of \(\$ 55\) each at the time of combination. Partial balance sheet data for the companies prior to the business combination and immediately following the combination are as follows:

\section*{Required}

a. What was the book value of Spice's inventory at the date of combination?

\(b\). What was the fair value of total assets reported by Spice at the date of combination?

c. What was the market value of Spice's bonds at the date of combination?

d. How many shares of common stock did Roto issue in completing the acquisition of Spice?

\(e\). What was the market price per share of Roto's stock at the date of combination?

f. What amount of goodwill. if any, did Spice have on its books prior to the business combination?

g. What amount of goodwill will be reported following the business combination if the combination is a purchase?

h. What amount of retained earnings did Spice report immediately before the combination?

i. What amount of retained eamings will be reported following the business combination if the combination is recorded as a purchase?

j. What amount of additional paid-in capital did Spice report at the date of combination?

k. Assume that prior to the time the business combination was completed. Roto paid audit fees of \(\$ 3.500\), finder's fees of \(\$ 5.000\), stock registration fees of \(\$ 4.000\), legal fees for property transfers of \(\$ 12.000\), and stock transfer fees of \(\$ 2.300\) in connection with the combination.

(1) Give the journal entry or entries recorded by Roto for these costs if the business combination is recorded as a pooling of interests.

(2) Give the journal entry or entries recorded by Roto for these costs if the business combination is recorded as a purchase.

(3) Taking these additional costs into consideration and assuming the business combination is recorded as a purchase, what amount of goodwill will be reported by the combined entity following the business combination?

(4) Taking these additional costs into consideration and assuming the business combination is recorded as a purchase, what amount of additional paid-in capital will be reported by the combined entity following the business combination?

(5) If the business combination is recorded as a pooling of interests, what effect will these costs have on the amounts reported as goodwill and additional paid-in capital by the combined entity? Explain.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King