On October 1, 20X5, XYZ Ltd. sold its 80% interest in the subsidiary, Sub Ltd., for $2,430,000.

Question:

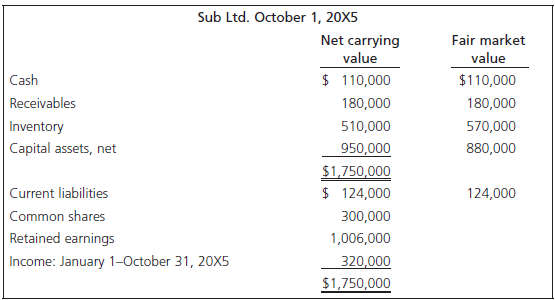

At the date of the sale, October 1, 20X5, the SFP of Sub Ltd. was:

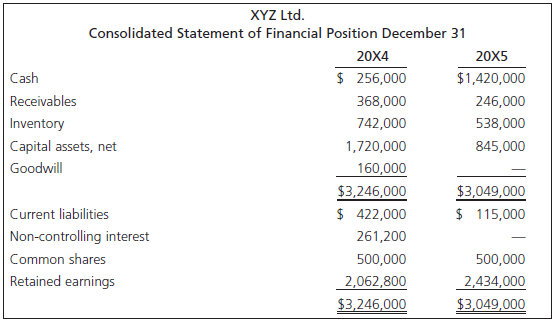

XYZ Ltd.€™s 20X4 and 20X5 consolidated statements of financial position were as follows:

The net income for the year for the consolidated entity was $371,200, but this was after the gain on the sale of the subsidiary. No dividends were paid. The consolidated depreciation expense was $104,000, which included the depreciation of the capital asset revaluation. Ignore the impact of income taxes on the sale.

Required

Calculate the gain or loss on the sale of the subsidiary.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay

Question Posted: