P Co acquired a 90% ownership interest in Y Co on 1 January 20x3. At the date

Question:

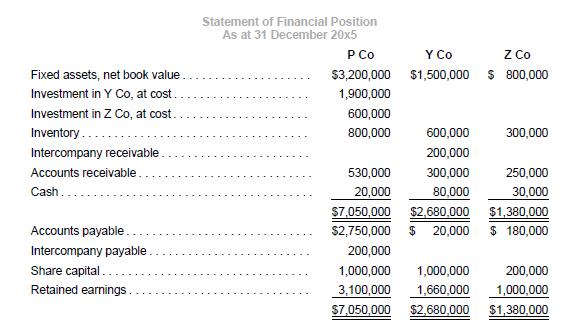

P Co acquired a 90% ownership interest in Y Co on 1 January 20x3. At the date of acquisition, the share capital of Y Co was $1,000,000, and the retained earnings balance was $500,000. The book values of assets of Y Co were close to their fair values, with except for inventory that was undervalued by $100,000. Y Co sold the undervalued inventory in 20x3. The fair value of non-controlling interests was $200,000 as at the date of acquisition.

On 1 January 20x4, P Co acquired a 30% ownership interest in Z Co. At that date, the share capital of Z Co was

$200,000 while its retained earnings balance was $400,000. Z Co had an unrecognized intangible asset with a reliable fair value of $240,000. The intangible asset had a useful life of five years from the date of acquisition.

In 20x4, Y Co sold inventory to P Co at a transfer price of $360,000. The original cost of the inventory was

$200,000. Ninety percent of the inventory remained unsold at the end of 20x4; 10% of the original inventory remained unsold as at the end of 20x5.

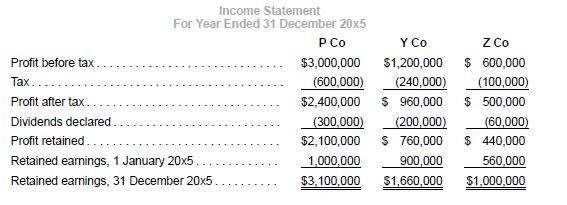

On 1 January 20x5, Z Co transferred machinery to P Co at an invoiced price of $296,000. The original cost of the machinery was $360,000; the profit on sale recorded by Z Co from the transfer was $8,000. The machinery had an original useful life of five years with no residual value. As at 1 January 20x5, the remaining useful life of the machinery was four years with no change to its estimated residual value. Assume a tax rate of 20%. Recognize tax effects of fair value adjustments. The financial statements for P Co, Y Co and Z Co for the financial year ended 31 December 20x5 are shown below.

Required

1. Prepare the consolidation and equity accounting entries for 20x5 (with narratives and workings).

2. Prepare a consolidation worksheet for the year ended 31 December 20x5 for the above companies.

3. Perform an analytical check on the year-end balances of non-controlling interests and investment in associate.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah