Packer Citys balance sheet and statement of revenues, expenditures, and changes in fund balances are shown below

Question:

Packer City’s balance sheet and statement of revenues, expenditures, and changes in fund balances are shown below for the governmental funds. Information on capital assets and long-term obligations are also provided from the notes to the financial statements.

Additional information:

a. Receivables include two items that were not available for current-period expenditures. These are $1,402,903 Advance to Water Utility and special assessments of $66,008.

b. Accrued interest payable was $114,765 on December 31, 2018, and it was $133,627 on December 31, 2019.

c. Funding of principal payments included in the tax levied, but to be used for future principal payments is $189,417.

d. Governmental activities deferred debits include unamortized debt expense of $104,357 (net of accumulated amortization of $12,777).

e. Special assessments receivable decreased $44,394.

f. Issue costs on the new debt (related to prepaid insurance costs) issued were $6,389. They are expensed, but are capitalized in the statement of activities.

g. Of the noncapitalized capital outlays, $920,000 are for police equipment and the balance, $1,115,616, is attributed to highway maintenance.

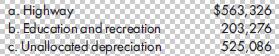

h. Depreciation expense is charged to the functions as follows:

i. There is very limited information upon which to allocate revenues, fees, and grants against expenditures. Do your best and just try to reflect the spirit of the process.

Required

1. Prepare a reconciliation schedule for balance sheet to statement of net position.

2. Prepare a reconciliation for statement of revenues, expenditures, and changes in fund balances to the statement of activities.

3. Based on part (1), prepare the statement of net position.

4. Based on part (2), prepare the statement of activities.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng