Panther Enterprises owns 80 percent of Strike Corporations voting stock. Panther acquired the shares on January 1,

Question:

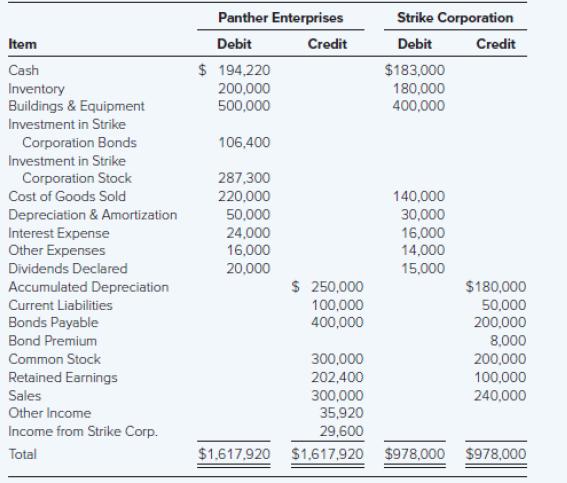

Panther Enterprises owns 80 percent of Strike Corporation’s voting stock. Panther acquired the shares on January 1, 20X4, for $234,500. On that date, the fair value of the noncontrolling interest was $58,625, and Strike reported common stock outstanding of $200,000 and retained earnings of $50,000. The book values and fair values of Strike’s assets and liabilities were equal except for buildings with a fair value $30,000 more than book value at the time of combination. The buildings had an expected 10-year remaining economic life from the date of combination. On December 31, 20X6, Panther’s management reviewed the amount attributed to goodwill as a result of the acquisition of Strike and concluded that an impairment loss of $7,500 should be recorded in 20X6, with the loss shared proportionately between the controlling and noncontrolling interests. The following trial balances were prepared by the companies on December 31, 20X6: Panther purchases much of its inventory from Strike. The inventory Panther held on January 1, 20X6, contained $2,000 of unrealized intercompany profit. During 20X6, Strike had sold goods costing $50,000 to Panther for $70,000. Panther had resold the inventory held at the beginning of the year and 70 percent of the inventory it purchased in 20X6 prior to the end of the year. The inventory remaining at the end of 20X6 was sold in 20X7.

On January 1, 20X6, Panther purchased from Kirkwood Corporation $100,000 par value bonds of Strike Corporation. Kirkwood had purchased the 10-year bonds on January 1, 20X1. The coupon rate is 9 percent and interest is paid annually on December 31. Assume Panther uses the modified equity method.

Required

Select the correct answer for each of the following questions.

1. What should be the total amount of inventory reported in the consolidated balance sheet as of December 31, 20X6?

a. $360,000

b. $374,000

c. $375,200

d. $380,000

2. What amount of cost of goods sold should be reported in the 20X6 consolidated income statement?

a. $288,000

b. $294,000

c. $296,000

d. $360,000

3. What amount of interest income did Panther Enterprises record from its investment in Strike Corporation bonds during 20X6?

a. $7,400

b. $7,720

c. $9,000

d. $10,600

4. What amount of interest expense should be reported in the 20X6 consolidated income statement?

a. $24,000

b. $32,000

c. $33,000

d. $40,000

5. What amount of goodwill would be reported by the consolidated entity at January 1, 20X4?

a. $10,500

b. $13,125

c. $34,500

d. $43,125

6. What amount of depreciation and amortization expense should be reported in the 20X6 consolidated income statement?

a. $77,000

b. $80,000

c. $82,400

d. $83,000

7. What amount of gain or loss on bond retirement should be included in the 20X6 consolidated income statement?

a. $2,400

b. $3,000

c. $4,000

d. $6,400

8. What amount of income should be assigned to the noncontrolling interest in the 20X6 consolidated income statement?

a. $4,620

b. $6,120

c. $6,720

d. $8,000

9. What amount should be assigned to the noncontrolling interest in the consolidated balance sheet as of December 31, 20X6?

a. $60,000

b. $63,320

c. $65,000

d. $68,645

10. What amount of goodwill, if any, should be reported in the consolidated balance sheet as of December 31, 20X6?

a. $0

b. $5,625

c. $10,500

d. $13,125

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd