Peace Corporation acquired 100 percent of Soft Inc. in a nontaxable transaction on December 31, 20X1. The

Question:

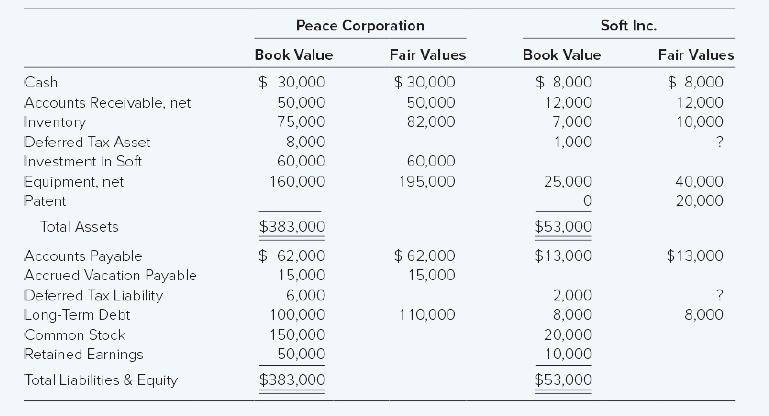

Peace Corporation acquired 100 percent of Soft Inc. in a nontaxable transaction on December 31, 20X1. The following balance sheet information is available immediately following the transaction:

Additional Information

1- The current and future effective tax rate for both Peace and Soft is 40 percent.

2- The recorded deferred tax asset for Peace relates to the book-tax differences arising from the allowance for doubtful accounts and the accrued vacation payable. The expenses associated with each of these amounts will not be deductible for tax purposes until the related accounts receivable are written off or until the employee vacation is actually paid out.

3- The recorded deferred tax asset for Soft is related solely to the book-tax differences arising from the allowance for doubtful accounts.

4- The recorded deferred tax liability in both Peace and Soft relates solely to the book-tax differences arising from the depreciation of their respective equipment.

5- Accumulated depreciation on the financial accounting records of Peace and Soft is $40,000 and $10,000, respectively.

6- The Soft patent was identified by Peace in the due diligence process and has not previously been recorded in the accounting records of Soft.

7- The book and tax bases of all other assets and liabilities of Peace and Soft are the same.

Required

a. Compute the tax bases of the assets and liabilities for Peace and Soft, where different from the amounts recorded in the respective accounting records.

b. Compute the fair value of the deferred tax assets and deferred tax liabilities for Soft.

c. Prepare all of the consolidation entries needed to prepare the worksheet for Peace and Soft at the date of acquisition.

d. Prepare the consolidation worksheet for Peace and Soft at the date of acquisition.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260165111

12th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd