Phone Corporation holds 80 percent of Smart Companys voting shares, acquired on January 1, 20X1, at underlying

Question:

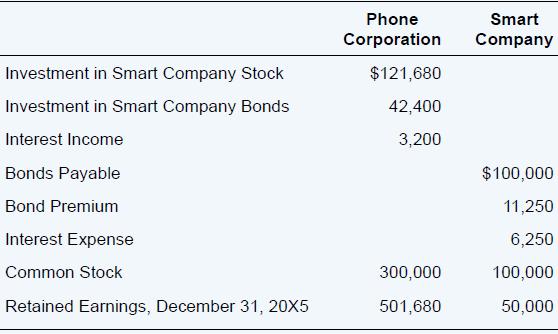

Phone Corporation holds 80 percent of Smart Company’s voting shares, acquired on January 1, 20X1, at underlying book value. On January 1, 20X4, Phone purchased Smart bonds with a par value of $40,000. The bonds pay 10 percent interest annually on December 31 and mature on December 31, 20X8. Phone uses the fully adjusted equity method in accounting for its ownership in Smart. Partial balance sheet data for the two companies on December 31, 20X5, are as follows:

Required

a. Compute the gain or loss on bond retirement reported in the 20X4 consolidated income statement.

b. What equity method entry would Phone make on its books related to the bond retirement in 20X5?

c. Prepare the consolidation entry needed to remove the effects of the intercorporate bond ownership in completing the consolidation worksheet for 20X5.

d. What balance should be reported as consolidated retained earnings on December 31, 20X5?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd