Pie Corporation acquired 80 percent of Slice Companys common stock on December 31, 20X5, at underlying book

Question:

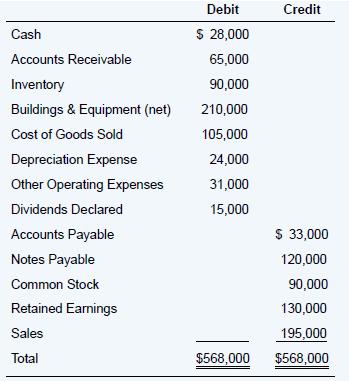

Pie Corporation acquired 80 percent of Slice Company’s common stock on December 31, 20X5, at underlying book value. The book values and fair values of Slice’s assets and liabilities were equal, and the fair value of the noncontrolling interest was equal to 20 percent of the total book value of Slice. Slice provided the following trial balance data at December 31, 20X5:

Required

a. How much did Pie pay to purchase its shares of Slice?

b. If consolidated financial statements are prepared at December 31, 20X5, what amount will be assigned to the noncontrolling interest in the consolidated balance sheet?

c. If Pie reported income of $143,000 from its separate operations for 20X5, what amount of consolidated net income will be reported for 20X5?

d. If Pie had purchased its ownership of Slice on January 1, 20X5, at underlying book value and Pie reported income of $143,000 from its separate operations for 20X5, what amount of consolidated net income would be reported for 20X5?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781265042615

13th International Edition

Authors: Theodore E. Christensen, David M. Cottrell, Cassy Budd