Pillow Corporation acquired 80 percent ownership of Sheet Company on January 1, 20X7, for $173,000. At that

Question:

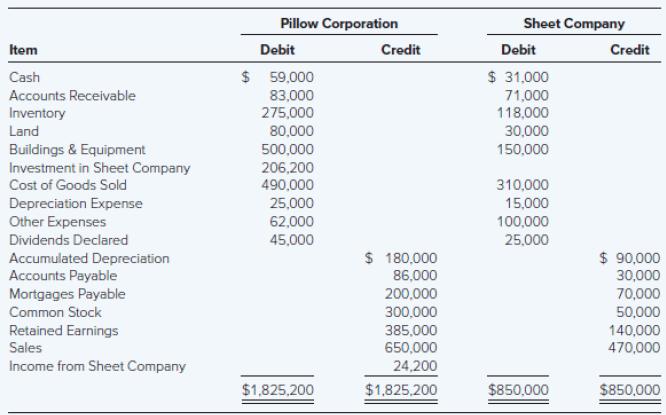

Pillow Corporation acquired 80 percent ownership of Sheet Company on January 1, 20X7, for $173,000. At that date, the fair value of the noncontrolling interest was $43,250. The trial balances for the two companies on December 31, 20X8, included the following amounts:

Additional Information

1. On January 1, 20X7, Sheet reported net assets with a book value of $150,000 and a fair value of $191,250. The difference between fair value and book value of Sheet’s net assets is related entirely to buildings and equipment. Accumulated depreciation on buildings and equipment was $60,000 on the acquisition date. Sheet’s depreciable assets had an estimated economic life of 11 years on the date of combination.

2. At December 31, 20X8, Pillow’s management reviewed the amount attributed to goodwill and concluded goodwill was impaired and should be reduced to $14,000. Goodwill and goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders.

3. Pillow used the equity method in accounting for its investment in Sheet.

4. Detailed analysis of receivables and payables showed that Pillow owed Sheet $9,000 on December 31, 20X8.

Required

a. Give all journal entries recorded by Pillow with regard to its investment in Sheet during 20X8.

b. Give all consolidation entries needed to prepare a full set of consolidated financial statements for 20X8.

c. Prepare a three-part consolidation worksheet as of December 31, 20X8.7

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd