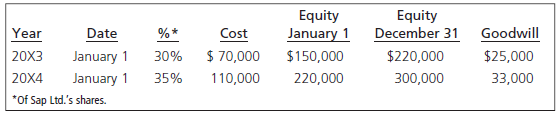

Pine Ltd. had the following transactions in the shares of Sap Ltd.: The income of Sap Ltd.

Question:

The income of Sap Ltd. is earned evenly over the year.

Pine purchased its shares in Sap at their market values on January 1, 20X3, and 20X4, respectively. Any excess of purchase price over carrying value is attributable solely to goodwill. The annual tests for goodwill impairment have indicated no impairment of goodwill since the date of acquisition. The market value of each share of Sap Ltd. on December 31, 20X4, was $3.25. There was no change in the share price between December 31, 20X3, and January 1, 20X4.

Sap Ltd. has 100,000 shares outstanding.

Required

How should Pine report its investment in Sap for 20X3 and 20X4, assuming no dividend, and using the cost, fair value, and equity methods?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay