Pole Manufacturing Corporation issued stock with a par value of $67,000 and a market value of $503,500

Question:

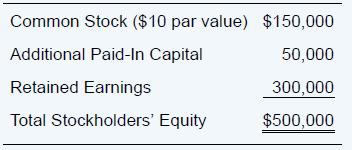

Pole Manufacturing Corporation issued stock with a par value of $67,000 and a market value of $503,500 to acquire 95 percent of Spencer Corporation’s common stock on August 30, 20X1. At that date, the fair value of the noncontrolling interest was $26,500. On January 1, 20X1, Spencer reported the following stockholders’ equity balances:

Spencer reported net income of $60,000 in 20X1, earned uniformly throughout the year, and declared and paid dividends of $10,000 on June 30 and $25,000 on December 31, 20X1. Pole accounts for its investment in Spencer Corporation using the equity method. Pole reported retained earnings of $400,000 on January 1, 20X1, and had 20X1 income of $140,000 from its separate operations. Pole paid dividends of $80,000 on December 31, 20X1.

Required

a. Compute consolidated retained earnings as of January 1, 20X1, as it would appear in comparative consolidated financial statements presented at the end of 20X1.

b. Compute consolidated net income and income to the controlling interest for 20X1.

c. Compute consolidated retained earnings as of December 31, 20X1.

d. Give the December 31, 20X1, balance of Pole Manufacturing’s investment in Spencer Corporation.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd