Pop Company acquired all of Soda Corporations common shares on January 2, 20X3, for $789,000. At the

Question:

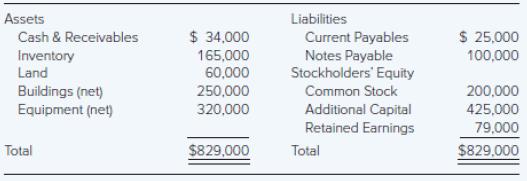

Pop Company acquired all of Soda Corporation’s common shares on January 2, 20X3, for $789,000. At the date of combination, Soda’s balance sheet appeared as follows:

The fair values of all of Soda’s assets and liabilities were equal to their book values except for its fixed assets. Soda’s land had a fair value of $75,000; the buildings had a fair value of $300,000; and the equipment had a fair value of $340,000.

Pop Company decided to employ push-down accounting for the acquisition of Soda Corporation. Subsequent to the combination, Soda continued to operate as a separate company.

Required

a. Record the acquisition of Soda’s stock on Pop’s books.

b. Present any entries that would be made on Soda’s books related to the business combination, assuming push-down accounting is used.

c. Present, in general journal form, all consolidation entries that would appear in a consolidation worksheet for Pop Company and its subsidiary prepared immediately following the combination.

Assets Cash & Receivables Inventory Land Buildings (net) Equipment (net) Total $ 34,000 165,000 60,000 250,000 320,000 $829,000 Liabilities Current Payables Notes Payable Stockholders' Equity Common Stock Additional Capital Retained Earnings Total $ 25,000 100,000 200,000 425,000 79,000 $829,000

Step by Step Answer:

a Entry to record acquisition of Soda stock on books ...View the full answer

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Jefferson Company acquired all of Louis Corporations common shares on January 2, 20X3, for $789,000. At the date of combination, Louiss balance sheet appeared as follows: The fair values of all of...

-

On December 31, 20X6, Greenly Corporation and Lindy Company entered into a business combination in which Greenly acquired all of Lindys common stock for $935,000. At the date of combination, Lindy...

-

Fran Corporation acquired all outstanding $10 par value voting common stock of Brey Inc. on January 1, 20X9, in exchange for 25,000 shares of its $20 par value voting common stock. On December 31,...

-

For problems involving composite bodies composed of two or more materials, the elasticity solution requires both boundary conditions and interface conditions between each material system. The...

-

Using the data given in E13- 25B, prepare the statement of cash flows for Eduardo Corporation for the year. The company uses the indirect method for operating activities. In E13-25B Net income...

-

Consider the papermaking process in Exercise 6.15. Set up a u chart based on an average sample size to control this process. In exercise Total Total Total Number Total Number Number Number Number...

-

Given the following data, calculate a level production plan, quarterly ending inventory, and average quarterly inventory. If inventory carrying costs are $6 per unit per quarter, what is the annual...

-

Ezzell Enterprises' noncallable bonds currently sell for $1,165. They have a 15-year maturity, an annual coupon of $95, and a par value of $1,000. What is their yield to maturity?

-

A policy Select one: a. specifically states what should or should not be done b. is used when dealing with unstructured problems and non- programmed decisions c. typically serves as a guideline for...

-

Name the following alcohols according to the IUPAC nomenclature system. Indicate stereochemistry (if any) and label the hydroxy groups as primary, secondary, or tertiary. OH Br OH (a) CH;CH,CHCH; (b)...

-

On December 31, 20X8, Paragraph Corporation acquired 80 percent of Sentence Companys common stock for $136,000. At the acquisition date, the book values and fair values of all of Sentences assets and...

-

Single Corporations balance sheet at January 1, 20X7, reflected the following balances: Plural Corporation, which had just entered into an active acquisition program, acquired 100 percent of Singles...

-

Oregano Inc. was formed on July 1, 2020. It was authorized to issue an unlimited number of common shares and 100,000 cumulative and non-participating preferred shares carrying a $2 dividend. The...

-

ProForm acquired 70 percent of ClipRite on June 30, 2020, for $1,470,000 in cash. Based on ClipRite's acquisition-date fair value, an unrecorded intangible of $600,000 was recognized and is being...

-

Consider the function f(x) = e^(cos(x)) USING MATLAB a) Write code that will approximate the definite integral of f(x) over [0, 1] using Simpson's rule with 100 evenly spaced subintervals. Compare...

-

What type of research funding method involves shared responsibility for conducting a research project and may grant the funder the authority to withdraw funding if the researcher does not adhere to...

-

Chapter 6 Assignment i 5 Problem 6-52 (LO 6-4) 12.5 points Jordan took a business trip from New York to Denver. She spent two days in travel, conducted business for nine days, and visited friends for...

-

need help completing my one-month project. anyone willing help me. Ellipses Corp One Month Project Ellipses Corp is a small business that operates in Herndon, VA. The company is located at10 Period...

-

Phan Company provided the following information: Standard variable overhead rate (SVOR) per direct labour hour ...................$3.70 Actual variable overhead rate (AVOR) per direct labour hour...

-

For the following exercises, write the first four terms of the sequence. a n = 2 n 2

-

Winston Corporation purchased 40 percent of the stock of Fullbright Company on January 1, 20X2, at underlying book value. The companies reported the following operating results and dividend payments...

-

Phillips Company bought 40 percent ownership in Jones Bag Company on January 1, 20X1, at underlying book value. In 20X1, 20X2, and 20X3, Jones Bag reported the following: The balance in Phillips...

-

Phillips Company bought 40 percent ownership in Jones Bag Company on January 1, 20X1, at underlying book value. In 20X1, 20X2, and 20X3, Jones Bag reported the following: The balance in Phillips...

-

question 6 Timely Inc. produces luxury bags. The budgeted sales and production for the next three months are as follows july. august september Sales, in units 1,115. 1229. 1302 Production. in units...

-

On May 12 Zimmer Corporation placed in service equipment (seven-year property) with a basis of $220,000. This was Zimmer's only asset acquired during the year. Calculate the maximum depreciation...

-

Power Manufacturing has equipment that it purchased 7 years ago for $2,550,000. The equipment was used for a project that was intended to last for 9 years and was being depreciated over the life of...

Study smarter with the SolutionInn App