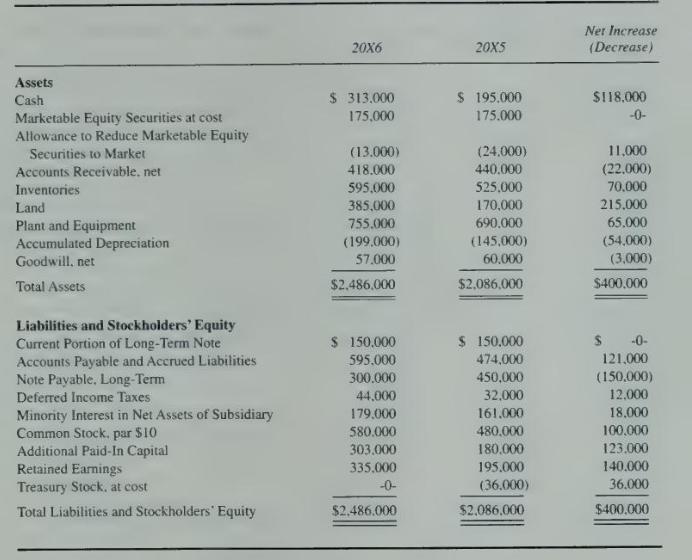

Presented below are the consolidated balance sheet accounts of Brimer Inc. and its subsidiary, Dore Corporation, as

Question:

Presented below are the consolidated balance sheet accounts of Brimer Inc. and its subsidiary, Dore Corporation, as of December 31, 20X6 and 20X5.

1. On January \(20,20 \mathrm{X} 6\), Brimer Inc. issued 10,000 shares of its common stock for land having a fair value of \(\$ 215.000\).

2. On February 5, 20X6. Brimer Inc. reissued all of its treasury stock for \(\$ 44,000\).

3. On May 15, 20X6, Brimer Inc. paid a cash dividend of \(\$ 58,000\) on its common stock.

4. On August 8, 20X6, equipment was purchased for \(\$ 127,000\).

5. On September 30. 20X6, equipment was sold for \(\$ 40,000\). The equipment cost \(\$ 62,000\) and had a carrying amount of \(\$ 34.000\) on the date of sale.

6. On December 15, 20X6, Dore Corporation paid a cash dividend of \(\$ 50,000\) on its common stock.

7. A goodwill impairment loss of \(\$ 3,000\) was recognized in 20X5.

8. Deferred income taxes represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial reporting.

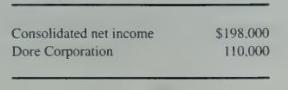

9. Net income for 20X6 was as follows:

10. Brimer Inc. owns 70 percent of its subsidiary, Dore Corporation. There was no change in the ownership interest in Dore Corporation during 20X5 and 20X6. There were no intercompany transactions other than the dividend paid to Brimer Inc. by its subsidiary.

\section*{Required}

Prepare a consolidated statement of cash flows for Brimer Inc. and its subsidiary for the year ended December 31, 20X6.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King