Prince Ltd bought 80% of Silver Ltd on 1 January 20x1 for $230,000 when Silvers statement of

Question:

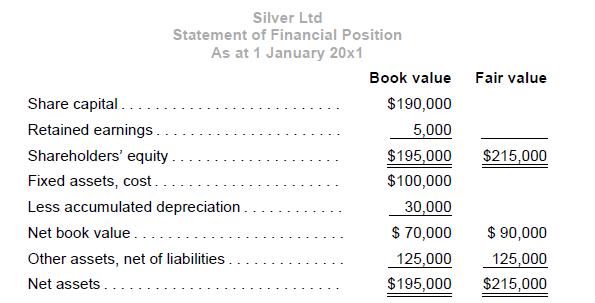

Prince Ltd bought 80% of Silver Ltd on 1 January 20x1 for $230,000 when Silver’s statement of financial position was as follows:

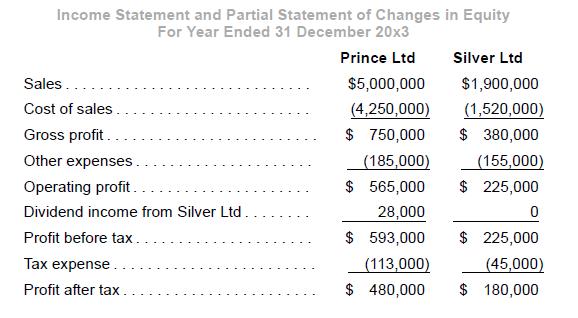

Fixed assets had a remaining useful life of five years as at 1 January 20x1. Goodwill impairment losses on the original goodwill of Silver attributable to parent and non-controlling interests are as follows:

(a) 20% of the original goodwill was deemed impaired and written off in 20x2.

(b) 10% of the original goodwill was written off in 20x3.

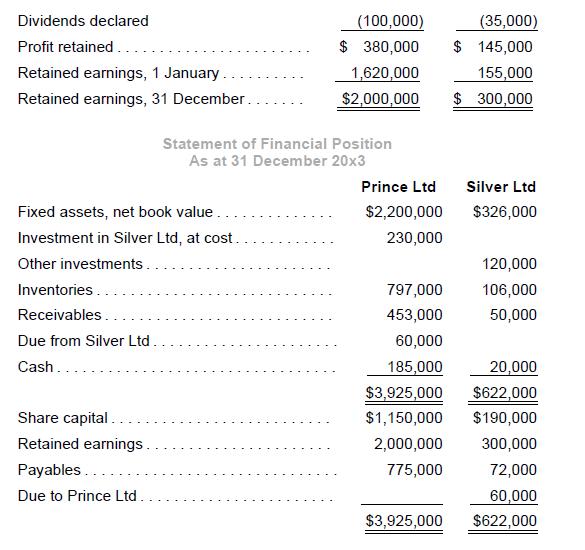

Fair value of non-controlling interests as at 1 January 20x1 was $55,000. The financial statements for the year ended 31 December 20x3 are as follows:

Required:

1. Prepare all necessary consolidation adjustments and elimination entries for the year ended 31 December 20x3.

Recognize tax effects at 20%.

2. Prepare the consolidation worksheet for the year ended 31 December 20x3.

3. Perform an analytical check on the balance of non-controlling interests as at 31 December 20x3.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah