Prism Co, a magazine publisher, reported net profit before tax of $1,300,000 for the year ended 31

Question:

Prism Co, a magazine publisher, reported net profit before tax of $1,300,000 for the year ended 31 December 20x1.

The only disallowed expenses were the depreciation on private motor vehicles of $7,000 and disallowed upkeep and maintenance expenses on the motor vehicle of $3,000. Tax rate as at 31 December 20x1 was 17% while the tax rate as at 31 December 20x0 was 18%.

Additional information

(1) Prism bought printing equipment on 1 January 20x0. The original cost was $480,000 and the economic useful life was five years. Capital allowances were claimed over three years from 1 January 20x0.

(2) A motor vehicle owned by Prism with original cost of $120,000 did not qualify for capital allowance claims. The economic useful life was ten years and the residual value was $50,000. As at 31 December 20x0, two years had expired from its initial purchase date.

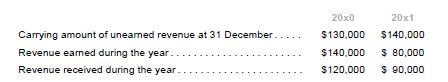

(3) Prism Co received magazine subscriptions from customers in advance and recognized the receipts as unearned revenue. Subscription revenues are taxable in the period when magazines are delivered. Prism recorded the following in 20x0 and 20x1.

Required

1. Determine the taxable temporary differences and deductible temporary differences as at 31 December 20x0 and 31 December 20x1.

2. Determine the tax expense for the year ended 31 December 20x1.

3. Prepare the journal entry to record the tax expense for the year ended 31 December 20x1.

4. Prepare the disclosure requirements to show the following:

(a) An explanation of the relationship between tax expense and accounting income by way of a numerical reconciliation between tax expense and the product of accounting profit multiplied by the applicable tax rate; and

(b) The amount of the deferred tax assets and liabilities recognized in the statement of financial position for each type of temporary differences.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah