Promise Enterprises purchased 90 percent of the voting common stock of Brown Corporation on January 1. 20X3,

Question:

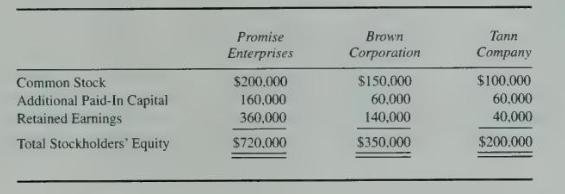

Promise Enterprises purchased 90 percent of the voting common stock of Brown Corporation on January 1. 20X3, for \(\$ 315,000\). Immediately after its ownership was acquired by Promise, Brown purchased 60 percent of the stock of Tann Company for \(\$ 120,000\). During 20X3, Promise Enterprises reported operating income of \(\$ 200,000\) and paid dividends of \(\$ 80,000\). Brown Corporation reported operating income of \(\$ 120,000\) and paid dividends of \(\$ 50,000\). Tann Company reported net income of \(\$ 40,000\) and paid dividends of \(\$ 15.000\). At January 1, 20X3, the stockholders' equity sections of the balance sheets of the companies were as follows:

\section*{Required}

a. Prepare the journal entries recorded by Brown Corporation for its investment in Tann Company during \(20 \times 3\).

b. Prepare the journal entries recorded by Promise Enterprises for its investment in Brown Corporation during 20X3

c. Prepare the eliminating entries related to Brown's investment in Tann and Promise's investment in Brown that are needed in preparing consolidated financial statements for Promise Enterprises and its subsidiaries at December 31, 20X3.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King