Protecto Corporation purchased 60 percent of Strand Companys outstanding shares on January 1, 20X1, for $24,000 more

Question:

Protecto Corporation purchased 60 percent of Strand Company’s outstanding shares on January 1, 20X1, for $24,000 more than book value. At that date, the fair value of the noncontrolling interest was $16,000 more than 40 percent of Strand’s book value. The full amount of the differential is considered related to patents and is being amortized over an eight-year period. In 20X1, Strand purchased a piece of land for $35,000 and later in the year sold it to Protecto for $45,000. Protecto is still holding the land as an investment. During 20X3, Protecto bonds with a value of $100,000 were exchanged for equipment valued at $100,000.

On January 1, 20X3, Protecto held inventory purchased previously from Strand for $48,000. During 20X3, Protecto purchased an additional $90,000 of goods from Strand and held $54,000 of this inventory on December 31, 20X3. Strand sells merchandise to the parent at cost plus a 20 percent markup. Strand also purchases inventory items from Protecto. On January 1, 20X3, Strand held inventory it had previously purchased from Protecto for $14,000, and on December 31, 20X3, it held goods it had purchased from Protecto for $7,000 during 20X3. Strand’s total purchases from Protecto in 20X3 were $22,000. Protecto sells inventory to Strand at cost plus a 40 percent markup.

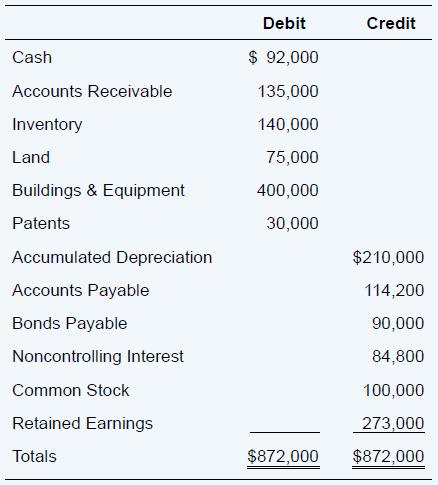

The consolidated balance sheet at December 31, 20X2, contained the following amounts:

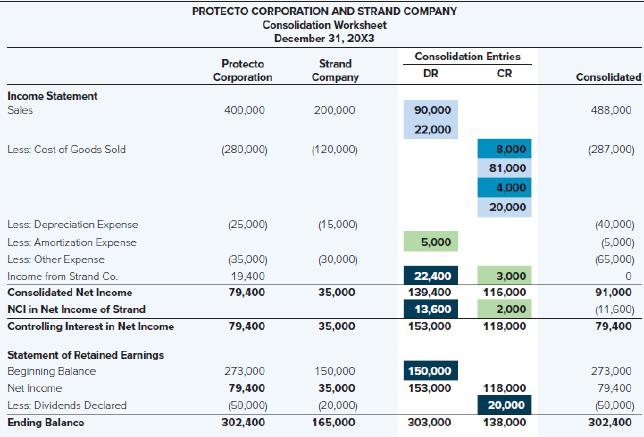

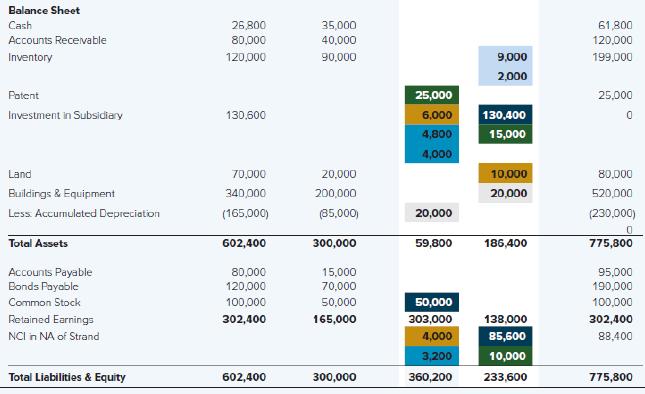

The following consolidation worksheet was prepared on December 31, 20X3. All consolidation entries and adjustments have been entered properly in the worksheet. Protecto accounts for its investment in Strand using the fully adjusted equity method.

Required

a. Prepare a worksheet for a consolidated statement of cash flows for 20X3 using the indirect method.

b. Prepare a consolidated statement of cash flows for 20X3.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd