Purple Manufacturing purchased 60 percent of the ownership of Socks Corporation stock on January 1, 20X1, at

Question:

Purple Manufacturing purchased 60 percent of the ownership of Socks Corporation stock on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Socks Corporation. Purple also purchased $50,000 of Socks bonds at par value on December 31, 20X3. Socks sold the bonds on January 1, 20X1, at 120; they have a stated interest rate of 12 percent. Interest is paid semiannually on June 30 and December 31. Assume Purple uses the fully adjusted equity method.

On December 31, 20X1, Socks sold a building with a remaining life of 15 years to Purple for $30,000. Socks had purchased the building 10 years earlier for $40,000. It is being depreciated based on a 25-year expected life.

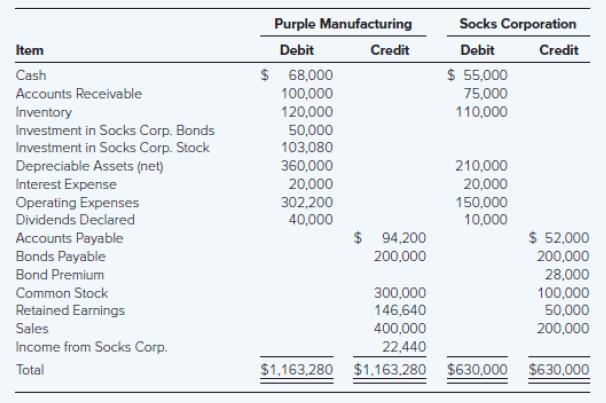

Trial balances for the two companies on December 31 20X3, are as follows

Required

a. Prepare a consolidation worksheet for 20X3 in good form.

b. Prepare a consolidated balance sheet, income statement, and statement of changes in retained earnings for 20X3.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd