Randall Corporation acquired 80 percent of the voting shares of Sharp Company on January 1, 20X4, for

Question:

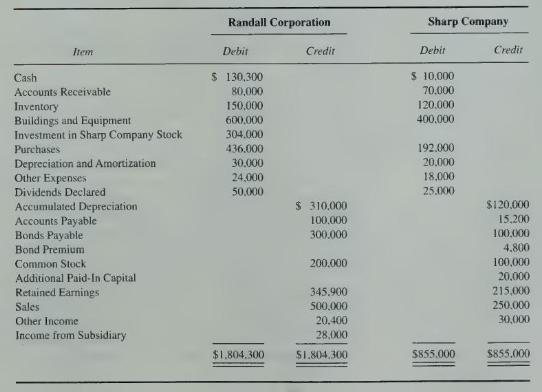

Randall Corporation acquired 80 percent of the voting shares of Sharp Company on January 1, 20X4, for \(\$ 280,000\) in cash and marketable securities. At the time of acquisition, Sharp Company reported net assets of \(\$ 300,000\). Trial balances for the two companies on December \(31,20 X 7\), are as follows:

1. Both companies use periodic inventory systems. At December 31, 20X7, Sharp Company reported ending inventory of \(\$ 110,000\), and Randall Corporation reported ending inventory of \(\$ 170,000\).

2. The purchase differential is appropriately assigned to buildings and equipment that had a remaining 10 -year economic life at the date of combination.

3. Randall Corporation and Sharp Company regularly purchase inventory from each other. During 20X6, Sharp sold inventory costing \(\$ 40,000\) to Randall Corporation for \(\$ 60,000\), and Randall resold 60 percent of the inventory in 20X6 and 40 percent in 20X7. Also in 20X6. Randall sold inventory costing \(\$ 20,000\) to Sharp for \(\$ 26,000\). Sharp resold two-thirds of the inventory in 20X6 and one-third in 20X7.

4. During 20X7, Sharp sold inventory costing \(\$ 30,000\) to Randall Corporation for \(\$ 45,000\), and Randall sold items purchased for \(\$ 9.000\) to Sharp for \(\$ 12,000\). Randall resold before the end of the year one-third of the inventory it purchased from Sharp in 20X7. Sharp continues to hold all the units purchased from Randall during 20X7.

5. Randall Corporation sold equipment originally purchased for \(\$ 75,000\) to Sharp for \(\$ 50,000\) on December 31, 20X5. Accumulated depreciation over the 12 years of use before the intercorporate sale was \(\$ 45,000\). The estimated remaining life at the time of transfer was eight years. Straight-line depreciation is used by both companies.

6. Sharp owes Randall \(\$ 10,000\) on account on December 31, 20X7.

\section*{Required}

a. Prepare the 20X7 journal entries recorded on the books of Randall Corporation related to its investment in Sharp Company if Randall uses the basic equity method.

b. Prepare all eliminating entries needed to complete a consolidation workpaper as of December \(31,20 \times 7\).

c. Prepare a three-part consolidation workpaper as of December 31, 20X7.

d. Prepare, in good form, a consolidated income statement, balance sheet, and retained earnings statement for 20X7.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King