Refer to P 4-7. During 20X8, the following events occurred: 1. Serena Inc. had sales of $800,000

Question:

1. Serena Inc. had sales of $800,000 to Pradeesh Corp. Serena€™s gross margin was still 40% of selling price. At year-end, $120,000 of these goods were still in Pradeesh€™s inventory.

2. On October 1, 20X8, Serena sold its land to Pradeesh for $185,000 (on which income taxes were due for $20,000). Pradeesh paid Serena $85,000 and gave a promissory note for $100,000 that was due in three years at 10% interest per year, simple interest to be paid at maturity.

3. The $60,000 that Serena owed to Pradeesh at the beginning of the year was repaid during 20X8.

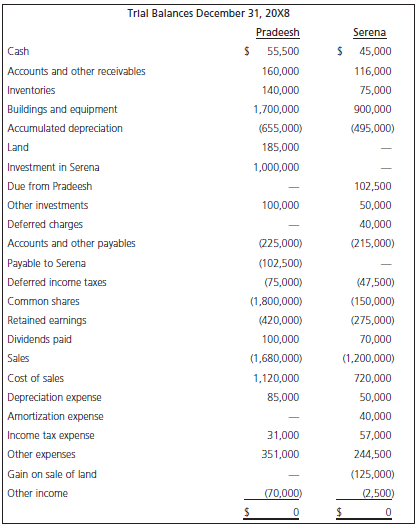

4. Pradeesh paid dividends of $100,000 during the year; Serena paid dividends of $70,000. The pre-closing trial balances of Pradeesh and Serena at December 31, 20X8, are shown below.

Required

a. Determine Pradeesh Corp.€™s equity in the earnings of Serena Inc. for 20X8. Determine the balance of the investment in the Serena account on Pradeesh€™s books at December 31, 20X8, assuming that Pradeesh recorded its investment on the equity basis. Show all calculations.

b. Prepare a comparative consolidated SFP and SCI for Pradeesh Corp. for 20X8. Show all calculations.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay