Refer to the preceding exchange rate information. Assume that Bartell acquired $10,500 of goodwill on January 1,

Question:

Refer to the preceding exchange rate information. Assume that Bartell acquired $10,500 of goodwill on January 1, 20X5, and the goodwill suffered a 10 percent impairment loss in 20X5. If the functional currency is the Malaysian ringgit, how much goodwill impairment loss should be reported on Bartell’s consolidated income statement for 20X5?

a. $1,050

b. $1,200

c. $1,100

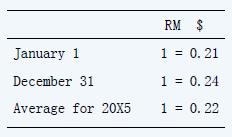

d. $1,175 Bartell Inc., a U.S. company, acquired 90 percent of the common stock of a Malaysian company on January 1, 20X5, for $160,000. The net assets of the Malaysian subsidiary amounted to 680,000 ringgit (RM) on the date of acquisition. On January 1, 20X5, the book values of the Malaysian subsidiary’s identifiable assets and liabilities approximated their fair values. Exchange rates at various dates during 20X5 follow:

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260165111

12th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd