Refer to the preceding facts for Penskes acquisition of Stock common stock. Penske accounts for its investment

Question:

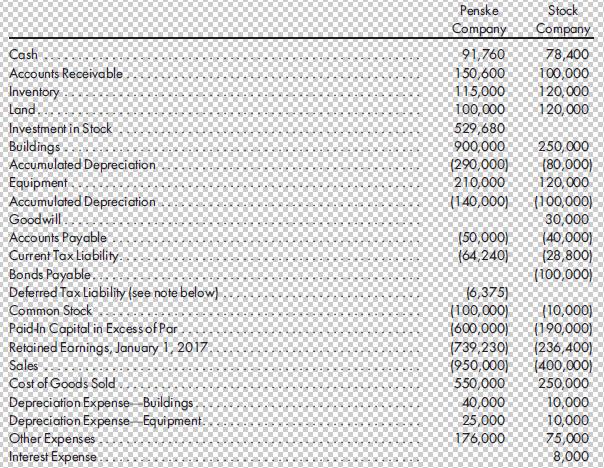

Refer to the preceding facts for Penske’s acquisition of Stock common stock. Penske accounts for its investment in Stock using the simple equity method, including income tax effects. During 2017, Stock sells $40,000 worth of merchandise to Penske. As a result of these intercompany sales, Penske holds beginning inventory of $16,000 and ending inventory of $10,000 of merchandise acquired from Stock. At December 31, 2017, Penske owes Stock $8,000 from merchandise sales. Stock has a gross profit rate of 30%.

During 2017, Penske sells $60,000 worth of merchandise to Stock. Stock holds $15,000 of this merchandise in its ending inventory. Stock owes $10,000 to Penske as a result of these intercompany sales. Penske has a gross profit rate of 40%.

On January 1, 2015, Penske sells equipment having a net book value of $50,000 to Stock for $90,000. The equipment has a 5-year useful life and is depreciated using the straight-line method.

On January 1, 2017, Stock sells equipment to Penske at a profit of $25,000. The equipment has a 5-year useful life and is depreciated using the straight-line method.

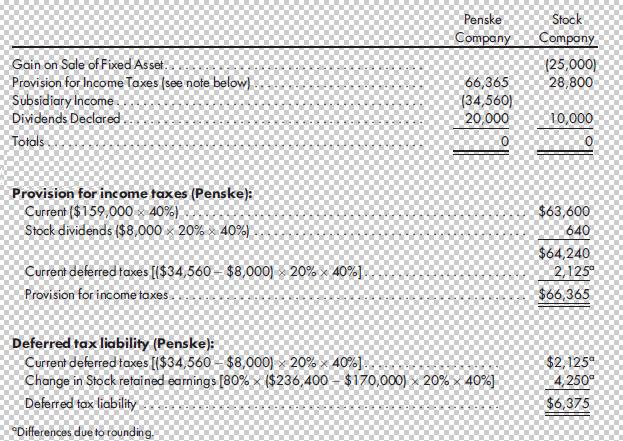

Penske and Stock do not qualify as an affiliated group for tax purposes and, thus, will file separate tax returns. Assume a 40% corporate tax rate and an 80% dividends received exclusion.

On December 31, 2017, Penske and Stock have the following trial balances:

Required

1. Prepare a value analysis and a determination and distribution of excess schedule.

2. Prepare a consolidated worksheet for the year ended December 31, 2017. Include a provision for income tax and income distribution schedules.

Preceding Facts for Penske’s Acquisition:

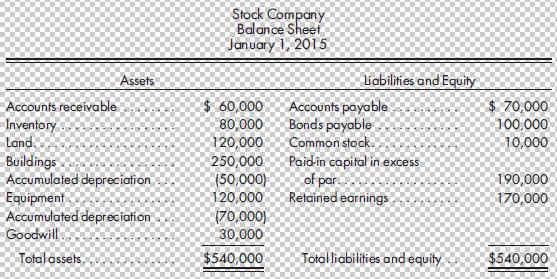

On January 1, 2015, Penske Company acquires an 80% interest in Stock Company for $450,000. Stock has the following balance sheet on the date of acquisition:

Buildings, which have a 20-year life, are undervalued by $100,000. Equipment, which has a 5-year life, is undervalued by $50,000. Any remaining excess of cost over book value is attributable to goodwill.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng