Rossman Corporation holds 75 percent of the common stock of Schmid Distributors Inc. The stock originally was

Question:

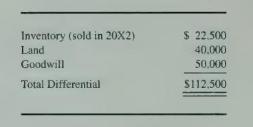

Rossman Corporation holds 75 percent of the common stock of Schmid Distributors Inc. The stock originally was purchased on December \(31,20 \mathrm{X} 1\), for \(\$ 2,340,000\). At the date of acquisition, Schmid reported common stock with a par value of \(\$ 1,000,000\), additional paid-in capital of \(\$ 1,350,000\), and retained earnings of \(\$ 620,000\). The differential at acquisition was attributable to the following items:

During 20X2, Rossman sold to Schmid at a gain of \(\$ 23,000\) a piece of land that it had purchased several years before; Schmid continues to hold the land. In 20X6, Rossman and Schmid entered into a five-year contract under which Rossman provides management consulting services to Schmid on a continuing basis; Schmid pays Rossman a fixed fee of \(\$ 80,000\) per year for these services. At December 31,20X8, Schmid owed Rossman \(\$ 20,000\) as the final \(20 \mathrm{X} 8\) quarterly payment under the contract.

On January 2, 20X8, Rossman purchased from Schmid for \(\$ 250,000\) equipment that Schmid was then carrying at \(\$ 290,000\). That equipment had been purchased by Schmid on December 27 , \(20 \mathrm{X} 2\), for \(\$ 435,000\). The equipment is expected to have a total life of 15 years and no salvage value. The amount of the differential assigned to goodwill is not amortized.

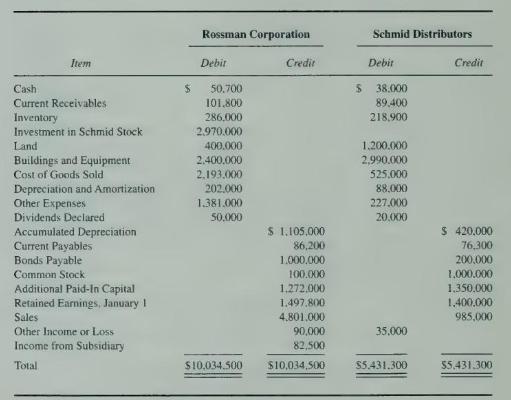

At December 31, 20X8, trial balances for Rossman and Schmid appeared as follows:

As of December 31,20X8, Schmid had declared but not yet paid its fourth-quarter dividend of \(\$ 5,000\). Both companies use straight-line depreciation and amortization. Rossman uses the basic equity method to account for its investment in Schmid Distributors.

\section*{Required}

a. Compute the amount of the differential as of January 1, 20X8.

b. Verify the balance in Rossman's Investment in Schmid Stock account as of December 31, 20X8.

c. Present all elimination entries that would appear in a three-part consolidation workpaper as of December 31, 20X8.

d. Prepare and complete a three-part workpaper for the preparation of consolidated financial statements for \(20 \mathrm{X} 8\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King