section*{E2-3 Multiple-Choice Questions on Equity-Method Reporting [AICPA Adapted]} Select the correct answer for each of the following

Question:

\section*{E2-3 Multiple-Choice Questions on Equity-Method Reporting [AICPA Adapted]}

Select the correct answer for each of the following questions.

1. On January 1, 20X5, the Swing Company purchased at book value 100,000 shares ( 20 percent) of the voting common stock of Harpo Instruments Inc. for \(\$ 1,200,000\). Direct costs associated with the purchase were \(\$ 50,000\). On December 1, 20X5, the board of directors of Harpo declared a dividend of \(\$ 2\) per share payable to holders of record on December \(28,20 \times 5\). The net income of Harpo for the year ended December \(31,20 X 5\), was \(\$ 1,600,000\). What should be the balance in Swing's Investment in Harpo Instruments Inc. account on December 31, 20X5?

a. \(\$ 1,200,000\).

b. \(\$ 1,250,000\).

c. \(\$ 1,370,000\).

d. \(\$ 1,520,000\).

2. Cox Company received dividends from its common stock investments during the year ended December 31, 20X4, as follows:

- A cash dividend of \(\$ 5.000\) from West Corporation, in which Cox owns a 2 percent interest.

- A cash dividend of \(\$ 50,000\) from Bell Corporation, in which Cox owns a 30 percent interest. A majority of Cox's directors are also directors of Bell.

- A stock dividend of 300 shares from Mill Corporation, received on December 10, 20X4, on which date the quoted market value of Mill's shares was \(\$ 10\) per share. Cox owns less than 1 percent of Mill's common stock.

How much dividend income should Cox report in its 20X4 income statement?

a. \(\$ 5,000\).

b. \(\$ 8,000\).

c. \(\$ 55,000\).

d. \(\$ 58,000\).

3. Grant Inc. acquired 30 percent of South Company's voting stock for \(\$ 200,000\) on January 2, 20X3. Grant's 30 percent interest in South gave Grant the ability to exercise significant influence over South's operating and financial policies. During 20X3. South earned \(\$ 80,000\) and paid dividends of \(\$ 50,000\). South reported earnings of \(\$ 100,000\) for the six months ended June 30, \(20 \mathrm{X} 4\), and \(\$ 200,000\) for the year ended December 31, 20X4. On July 1, 20X4, Grant sold half of its stock in South for \(\$ 150.000\) cash. South paid dividends of \(\$ 60,000\) on October 1, 20X4. In its 20X4 income statement, what amount should Grant report as the gain from the sale of half of its investment?

a. \(\$ 24,500\).

b. \(\$ 30.500\).

c. \(\$ 35,000\).

d. \(\$ 45,500\).

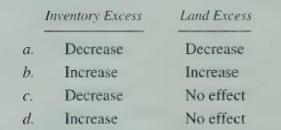

4. Park Company uses the equity method to account for its January 1, 20X6, purchase of Tun Inc.'s common stock. On January 1, 20X6, the fair value of Tun's FIFO inventory and land exceeded their carrying amounts. How do these excesses of fair values over carrying amounts affect Park's reported equity in Tun's 20X6 earnings?

5. On July 1. 20X8. Denver Corporation purchased 3,000 shares of Eagle Company's 10,000 outstanding shares of common stock for \(\$ 20\) per share. On December 15, 20X8, Eagle paid \(\$ 40,000\) in dividends to its common stockholders. Eagle's net income for the year ended December 31, 20X8, was \(\$ 120,000\), earned evenly throughout the year. In its \(20 \mathrm{X} 8\) income statement, what amount of income from this investment should Denver report?

a. \(\$ 36,000\).

b. \(\$ 18,000\).

c. \(\$ 12,000\).

d. \(\$ 6,000\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King