Select the correct answer for each of the following questions. 1. What is the theoretically preferred method

Question:

Select the correct answer for each of the following questions.

1. What is the theoretically preferred method of presenting a noncontrolling interest in a consolidated balance sheet?

a. As a separate item within the liability section.

b. As a deduction from (contra to) goodwill from consolidation, if any.

c. By means of notes or footnotes to the balance sheet.

d. As a separate item within the stockholders' equity section.

2. Presenting consolidated financial statements this year when statements of individual companies were presented last year is:

a. A correction of an error.

b. An accounting change that should be reported prospectively.

c. An accounting change that should be reported by restating the financial statements of all prior periods presented.

d. Not an accounting change.

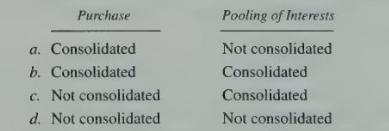

3. If all other conditions for consolidation are met, how should subsidiaries acquired in a business combination be shown under each of the following methods?

4. A subsidiary, acquired for cash in a business combination, owned equipment with a market value in excess of book value as of the date of combination. A consolidated balance sheet prepared immediately after the acquisition would treat this excess as:

a. Goodwill.

b. Plant and equipment.

c. Retained earnings.

d. Deferred credits.

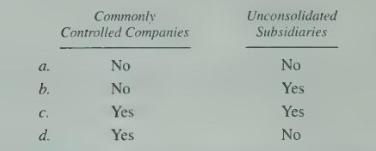

5. When combined financial statements are prepared for a group of related companies, intercompany transactions and intercompany profits or losses should be eliminated when the group is composed of:

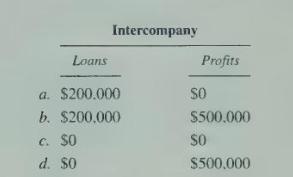

6. Mr. Cord owns four corporations. Combined financial statements are being prepared for these corporations, which have intercompany loans of \(\$ 200.000\) and intercompany profits of \(\$ 500,000\). What amount of these intercompany loans and profits should be included in the combined financial statements?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King