Select the correct answer for each of the following questions. 1. During 20X3. Park Corporation recorded sales

Question:

Select the correct answer for each of the following questions.

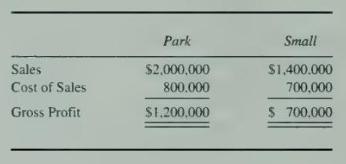

1. During 20X3. Park Corporation recorded sales of inventory costing \(\$ 500,000\) to Small Company, its wholly owned subsidiary, on the same terms as sales made to third parties. At December 31, 20X3, Small held one-fifth of these goods in its inventory. The following information pertains to Park and Small's sales for 20X3:

In its \(20 \mathrm{X} 3\) consolidated income statement, what amount should Park report as cost of sales?

a. \(\$ 1,000.000\).

b. \(\$ 1,060,000\).

c. \(\$ 1,260,000\).

d. \(\$ 1,500,000\).

Items 2 through 6 are based on the following:

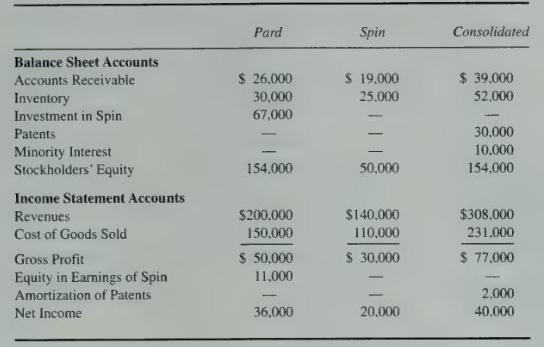

Selected information from the separate and consolidated balance sheets and income statements of Pard Inc. and its subsidiary. Spin Company, as of December 31, 20X8, and for the year then ended is as follows:

- During 20X8, Pard sold goods to Spin at the same markup on cost that Pard uses for all sales. At December 31, 20X8, Spin had not paid for all of these goods and still held 37.5 percent of them in inventory.

- Pard acquired its interest in Spin on January 2, 20X5. Pard's policy is to amortize patents by the straight-line method.

2. What was the amount of intercompany sales from Pard to Spin during 20X8?

a. \(\$ 3,000\).

b. \(\$ 6,000\).

c. \(\$ 29,000\).

d. \(\$ 32,000\).

3. At December \(31,20 \times 8\), what was the amount of Spin's payable to Pard for intercompany sales?

a. \(\$ 3,000\).

b. \(\$ 6,000\).

c. \(\$ 29,000\).

d. \(\$ 32,000\).

4. In Pard's consolidated balance sheet, what was the carrying amount of the inventory that Spin purchased from Pard?

a. \(\$ 3,000\).

b. \(\$ 6,000\).

c. \(\$ 9,000\).

d. \(\$ 12,000\).

5. What is the percent of minority interest ownership of Spin?

a. 10 percent.

b. 20 percent.

c. 25 percent.

d. 45 percent.

6. Over how many years has Pard chosen to amortize patents?

a. 15 years.

b. 19 years.

c. 23 years.

d. 40 years.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King