Select the correct answer for each of the following questions. 1. In considering interim financial reporting, how

Question:

Select the correct answer for each of the following questions.

1. In considering interim financial reporting, how did the Accounting Principles Board conclude that such reporting should be viewed?

a. As a "special" type of reporting that need not follow generally accepted accounting principles.

b. As useful only if activity is evenly spread throughout the year so that estimates are unnecessary.

c. As reporting for a basic accounting period.

d. As reporting for an integral part of an annual period.

2. Which of the following is an inherent difficulty in determining the results of operations on an interim basis?

a. Cost of sales reflects only the amount of product expense allocable to revenue recognized as of the interim date.

b. Depreciation on an interim basis is a partial estimate of the actual annual amiount.

c. Costs expensed in one interim period may benefit other periods.

d. Revenue from long-term construction contracts accounted for by the percentage-ofcompletion method is based on annual completion, and interim estimates may be incorrect.

3. Which of the following reporting practices is permissible for interim financial reporting?

a. Use of the gross profit method for interim inventory pricing.

\(b\). Use of the direct costing method for determining manufacturing inventories.

c. Deferral of unplanned variances under a standard cost system until year-end.

d. Deferral of nontemporary inventory market declines until year-end.

4. On January 1, 20X2, Harris Inc. paid property taxes on its plant for the calendar year 20X2, amounting to \(\$ 40,000\). In March 20X2, Harris made annual major repairs to its machinery amounting to \(\$ 120,000\). These repairs will benefit the entire calendar year's operations. How should these expenses be reflected in Harris's quarterly income statements?

5. An inventory loss from market decline of \(\$ 420,000\) occurred for the Wenger Company in April 20X2. The company recorded this loss in April 20X2 after its March 31, 20X2, quarterly report was issued. None of this loss was recovered by the end of the year. How should this loss be reflected in Wenger's quarterly income statements?

6. A company that uses the last-in, first-out (LIFO) method of inventory costing finds, at an interim reporting date, that there has been a partial liquidation of the base-period inventory level. The decline is considered temporary, and the base inventory will be replaced before year-end. The amount shown as inventory on the interim reporting date should:

a. Not give effect to the LIFO liquidation, and cost of sales for the interim reporting period should include the expected cost of replacement of the liquidated LIFO base.

b. Be shown at the actual level, and cost of sales for the interim reporting period should reflect the decrease in LIFO base-period inventory level.

c. Not give effect to the LIFO liquidations, and cost of sales for the interim reporting period should reflect the decrease in LIFO base-period inventory level.

d. Be shown at the actual level, and the decrease in inventory level should not be reflected in the cost of sales for the interim reporting period.

7. During the second quarter of 20X5, Camerton Company sold a piece of equipment at a \(\$ 12,000\) gain. What portion of the gain should Camerton report in its income statement for the second quarter of \(20 \mathrm{X} 5\) ?

a. \(\$ 12,000\).

b. \(\$ 6,000\).

c. \(\$ 4,000\).

d. \(\$ 0\).

8. On March 15, 20X1, Burge Company paid property taxes of \(\$ 180,000\) on its factory building for calendar year 20X1. On April 1, 20X1, Burge made \(\$ 300,000\) in unanticipated repairs to its plant equipment. The repairs will benefit operations for the remainder of the calendar year. What total amount of these expenses should be included in Burge's quarterly income statement for the three months ended June \(30,20 \mathrm{X} 1\) ?

a. \(\$ 75,000\).

b. \(\$ 145,000\).

c. \(\$ 195,000\).

d. \(\$ 345,000\).

9. The SRB Company had an inventory loss from a market price decline which occurred in the first quarter. The loss was not expected to be restored in the fiscal year. However, in the third quarter the inventory had a market price recovery that exceeded the first-quarter decline. For interim financial reporting, the dollar amount of net inventory should:

a. Decrease in the first quarter by the amount of the market price decline and increase in the third quarter by the amount of the market price recovery.

\(b\). Decrease in the first quarter by the amount of the market price decline and increase in the third quarter by the amount of the decrease in the first quarter.

c. Not be affected in the first quarter and increase in the third quarter by the amount of the market price recovery that exceeded the amount of the market price decline.

d. Not be affected in either the first quarter or the third quarter.

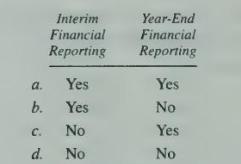

10. For external reporting purposes, it is appropriate to use estimated gross profit rates to determine the cost of goods sold for:

11. On June 30, 20X5, Park Corporation incurred a \(\$ 100,000\) net loss from disposal of a business segment. Also, on June 30. 20X5, Park paid \(\$ 40,000\) for property taxes assessed for the calendar year 20X5. What amount of the foregoing items should be included in the determination of Park's net income or loss for the six-month interim period ended June 30, 20X5?

a. \(\$ 140,000\).

b. \(\$ 120,000\).

c. \(\$ 90,000\).

d. \(\$ 70,000\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King