Select the correct answer for each of the following questions. 1. On May 1, 20X1, Cathy and

Question:

Select the correct answer for each of the following questions.

1. On May 1, 20X1, Cathy and Mort formed a partnership and agreed to share profits and losses in the ratio of 3:7, respectively. Cathy contributed a parcel of land that cost her \(\$ 10,000\). Mort contributed \(\$ 40,000\) cash. The land was sold for \(\$ 18,000\) on May 1, 20X1, immediately after formation of the partnership. What amount should be recorded in Cathy's capital account on formation of the partnership?

a. 18,000 .

b. \(\$ 17,400\).

c. \(\$ 15,000\).

d. \(\$ 10,000\).

2. On July 1, 20X1, a partnership was formed by James and Short. James contributed cash. Short, previously a sole proprietor, contributed property other than cash, including realty subject to a mortgage, which was assumed by the partnership. Short's capital account at July 1, 20X1, should be recorded at:

a. Short's book value of the property at July 1, 20X1.

b. Short's book value of the property less the mortgage payable at July 1, 20X1.

c. The fair value of the property less the mortgage payable at July 1, 20X1.

d. The fair value of the property at July 1, 20X1.

3. A partnership is formed by two individuals who were previously sole proprietors. Property other than cash which is part of the initial investment in the partnership would be recorded for financial accounting purposes at the:

a. Proprietors' book values or the fair value of the property at the date of the investment, whichever is higher.

b. Proprietors' book values or the fair value of the property at the date of the investment, whichever is lower.

c. Proprietors' book values of the property at the date of the investment.

d. Fair value of the property at the date of the investment.

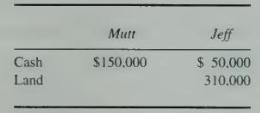

4. Mutt and Jeff formed a partnership on April 1 and contributed the following assets:

The land was subject to a mortgage of \(\$ 30.000\), which was assumed by the partnership. Under the partnership agreement, Mutt and Jeff will share profit and loss in the ratio of one-third and two-thirds respectively. Jeff's capital account at April 1 should be:

a. \(\$ 300,000\).

b. \(\$ 330,000\)

c. \(\$ 340,000\).

d. \(\$ 360,000\)

5. On July 1, Mabel and Pierre formed a partnership, agreeing to share profits and losses in the ratio of \(4: 6\) respectively. Mabel contributed a parcel of land that cost her \(\$ 25,000\). Pierre contributed \(\$ 50,000\) cash. The land was sold for \(\$ 50,000\) on July 1, four hours after formation of the partnership. How much should be recorded in Mabel's capital account on formation of the partnership?

a. \(\$ 10,000\).

b. \(\$ 20,000\).

c. \(\$ 25,000\).

d. \(\$ 50,000\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King