Select the correct answer for each of the following questions. 1. One of the differences between accounting

Question:

Select the correct answer for each of the following questions.

1. One of the differences between accounting for a governmental (not-for-profit) unit and a commercial (for-profit) enterprise is that a governmental unit should:

a. Not record depreciation expense in any of its funds.

b. Always establish and maintain complete self-balancing accounts for each fund.

c. Use only the cash basis of accounting.

d. Use only the modified accrual basis of accounting.

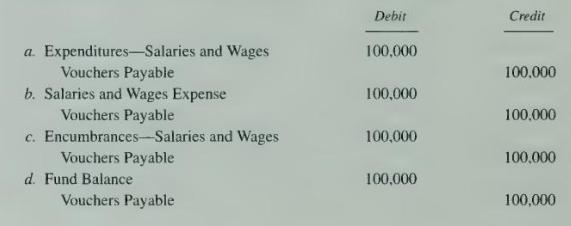

2. Belle Valley incurred \(\$ 100,000\) of salaries and wages for the month ended March 31, 20X2. How should this be recorded on that date?

3. Which of the following expenditures is normally recorded on the accrual basis in the general fund?

3. Which of the following expenditures is normally recorded on the accrual basis in the general fund?

a. Interest.

b. Personal services.

c. Inventory items.

d. Prepaid expenses.

4. Which of the following accounts of a governmental unit is credited when taxpayers are billed for property taxes?

a. Estimated Revenue.

b. Revenue.

c. Appropriations.

d. Fund Balance Reserved for Encumbrances.

5. Fixed assets purchased from general fund revenue were received. What account, if any, should have been debited in the general fund?

a. No journal entry should have been made in the general fund.

b. Fixed Assets.

c. Expenditures.

d. Unreserved Fund Balance.

6. The initial transfer of cash from the general fund in order to establish an internal service fund would require the general fund to credit Cash and debit:

a. Accounts Receivable-Internal Service Fund.

b. Transfers Out.

c. Budgetary Fund Balance Reserved for Encumbrances.

d. Expenditures.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King