Select the correct answer for each of the following questions. 1. On December 31, 20X7, Judy is

Question:

Select the correct answer for each of the following questions.

1. On December 31, 20X7, Judy is a fully vested participant in a company-sponsored pension plan. According to the plan's administrator. Judy has at that date the nonforfeitable right to receive a lump sum of \(\$ 100,000\) on December 28, 20X8. The discounted amount of \(\$ 100,000\) is \(\$ 90,000\) at December 31, 20X7. The right is not contingent on Judy's life expectancy and requires no future performance on Judy's part. In Judy's December 31, 20X7, personal statement of financial condition, the vested interest in the pension plan should be repored at:

a. \(\$ 0\).

b. \(\$ 90,000\).

c. \(\$ 95,000\).

d. \(\$ 100,000\).

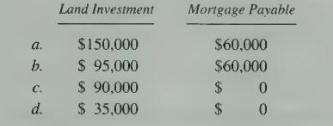

2. On December 31, 20X7, Mr. and Mrs. McManus owned a parcel of land held as an investment. The land was purchased for \(\$ 95,000\) in \(20 \mathrm{X} 0\), and was encumbered by a mortgage with a principal balance of \(\$ 60,000\) at December 31, 20X7. On this date the fair value of the land was \(\$ 150,000\). In the McManuses' December 31, 20X7, personal statement of financial condition, at what amount should the land investment and mortgage payable be reported?

3. Rich Drennen's personal statement of financial condition at December 31, 20X6, shows net worth of \(\$ 400,000\) before consideration of employee stock options owned on that date. Information relating to the stock options is as follows:

1. Options are to purchase 10,000 shares of Oglesby Corporation stock.

2. Options exercise price is \(\$ 10\) a share.

3. Options expire on June 30, \(20 \times 7\).

4. Market price of the stock is \(\$ 25\) a share on December 31, 20X6.

5. Assume that exercise of the options in \(20 \mathrm{X} 7\) would result in ordinary income taxable at 35 percent.

After giving effect to the stock options, Drennen's net worth at December 31, 20X6, would be:

a. \(\$ 497,500\).

b. \(\$ 550,000\).

c. \(\$ 562,500\).

d. \(\$ 650,000\).

4. Nancy Emerson owns 50 percent of the common stock of Marks Corporation. Emerson paid \(\$ 25,000\) for this stock in 20X3. At December 31, 20X8, it was ascertained that Emerson's 50 percent stock ownership in Marks had a current value of \(\$ 185.000\). Mark's cumulative net income and cash dividends declared for the five years ended December 31, 20X8, were \(\$ 300,000\) and \(\$ 30,000\) respectively. In Emerson's personal statement of financial condition at December 31, 20X8, what amount should be reported as her net investment in Marks?

a. \(\$ 25,000\).

b. \(\$ 160,000\).

c. \(\$ 175,000\).

d. \(\$ 185,000\)

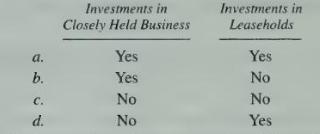

5. In a personal statement of financial condition, which of the following should be reported at estimated current values?

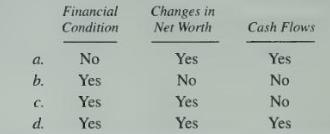

6. Personal financial statements should include which of the following statements?

7. A business interest that constitutes a large part of an individual's total assets should be presented in a personal statement of financial condition as:

a. A single amount equal to the proprietorship equity.

b. A single amount equal to the estimated current value of the business interest.

c. A separate listing of the individual assets and liabilities, at cost.

d. Separate line items of both total assets and total liabilities, at cost.

8. Personal financial statements should report assets and liabilities at:

a. Historical cost.

b. Historical cost and, as additional information, at estimated current values at the date of the financial statements.

c. Estimated current values at the date of the financial statements.

d. Estimated current values at the date of the financial statements and, as additional information, at historical cost.

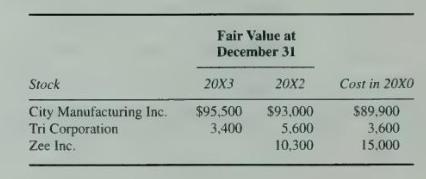

9. The following information pertains to marketable equity securities owned by Kent:

The Zee stock was sold in January 20X3 for \(\$ 10,200\). In Kent's personal statement of financial condition at December \(31,20 \mathrm{X} 3\), what amount should be reported for marketable equity securities?

a. \(\$ 93,300\).

b. \(\$ 93,500\).

c. \(\$ 94,100\).

d. \(\$ 98,900\).

10. Personal financial statements should report an investment in life insurance at the:

a. Face amount of the policy less the amount of premiums paid.

b. Cash value of the policy less the amount of any loans against it.

c. Cash value of the policy less the amount of premiums paid.

d. Face amount of the policy less the amount of any loans against it.

11. Mrs. Taft owns a \(\$ 150,000\) insurance policy on her husband's life. The cash value of the policy is \(\$ 125,000\), and there is a \(\$ 50,000\) loan against the policy. In the Tafts' personal statement of financial condition at December 31, 20X3, what amount should be shown as an investment in life insurance?

a. \(\$ 150,000\).

b. \(\$ 125,000\).

c. \(\$ 100,000\).

d. \(\$ 75,000\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King