Select the correct answer for each of the following questions. Questions 1, 2, and 3 are based

Question:

Select the correct answer for each of the following questions.

Questions 1, 2, and 3 are based on the following information:

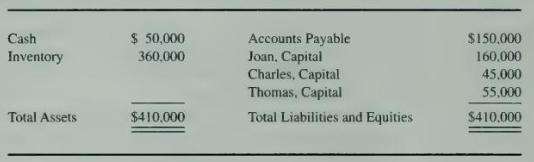

The balance sheet for the partnership of Joan, Charles, and Thomas, whose shares of profits and losses are 40,50 , and 10 percent, is as follows:

1. If the inventory is sold for \(\$ 300,000\), how much should Joan receive upon liquidation of the partnership?

a. \(\$ 48,000\).

b. \(\$ 100,000\).

c. \(\$ 136,000\)

d. \(\$ 160,000\)

2. If the inventory is sold for \(\$ 180,000\), how much should Thomas receive upon liquidation of the partnership?

a. \(\$ 28,000\).

b. \(\$ 32,500\).

c. \(\$ 37,000\).

d. \(\$ 55,000\).

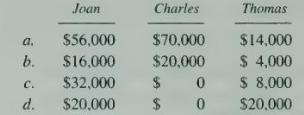

3. The partnership will be liquidated in installments. As cash becomes available, it will be distributed to the partners. If inventory costing \(\$ 200,000\) is sold for \(\$ 140,000\), how much cash should be distributed to each partner at this time?

4. In accounting for the liquidation of a partnership, cash payments to partners after all nonpartner creditors' claims have been satisfied, but before the final cash distribution, should be according to:

a. The partners' relative profit and loss sharing ratios.

b. The final balances in partner capital accounts.

c. The partners' relative share of the gain or loss on liquidations.

d. Safe payments computations.

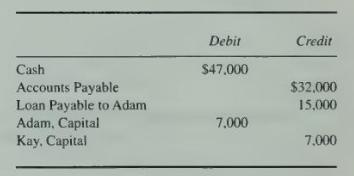

5. After all noncash assets have been converted into cash in the liquidation of the Adam and Kay partnership, the ledger contains the following account balances:

Available cash should be distributed with \(\$ 32,000\) going to accounts payable and:

a. \(\$ 15,000\) to the loan payable to Adam.

b. \(\$ 7,500\) each to Adam and Kay.

c. \(\$ 8,000\) to Adam and \(\$ 7,000\) to Kay.

d. \(\$ 7,000\) to Adam and \(\$ 8,000\) to Kay.

Questions 6 and 7 are based on the following information.

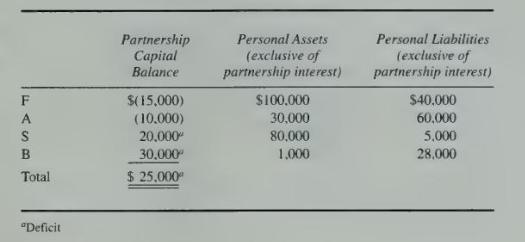

\(\mathrm{F}, \mathrm{A}, \mathrm{S}\), and \(\mathrm{B}\) are partners sharing profits and losses equally. The partnership is insolvent and is to be liquidated. The status of the partnership and each partner is as follows:

6. The partnership creditors:

a. Must first seek recovery against \(\mathrm{S}\) because she is personally solvent and has a negative capital balance.

b. Will not be paid in full regardless of how they proceed legally because the partnership assets are less than the partnership liabilities.

c. Will have to share A's interest in the partnership on a pro rata basis with A's personal creditors.

d. Have first claim to the partnership assets before any partner's personal creditors have rights to the partnership assets.

7. The partnership creditors may obtain recovery of their claims:

a. In the amount of \(\$ 6,250\) from each partner.

b. From the personal assets of either F or A.

c. From the personal assets of either \(\mathrm{S}\) or \(\mathrm{B}\).

d. From the personal assets of either \(\mathrm{F}\) or \(\mathrm{S}\) for all or some of their claims.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King