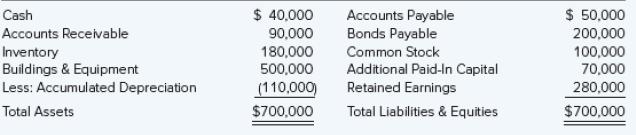

Sound Manufacturing Corporation prepared the following balance sheet as of January 1, 20X8: The company is considering

Question:

Sound Manufacturing Corporation prepared the following balance sheet as of January 1, 20X8:

The company is considering a 2-for-1 stock split, a stock dividend of 4,000 shares, or a stock dividend of 1,500 shares on its $10 par value common stock. The current market price per share of Sound stock on January 1, 20X8, is $50. Promise Sales Corporation acquired 68 percent of Sound’s common shares on January 1, 20X4, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 32 percent of Sound’s book value.

Required

Give the investment consolidation entry required to prepare a consolidated balance sheet at the close of business on January 1, 20X8, for each of the alternative transactions under consideration by Sound.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9781260772135

13th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd