Stacey Corporation owns 80 percent of the common shares and 70 percent of the preferred shares of

Question:

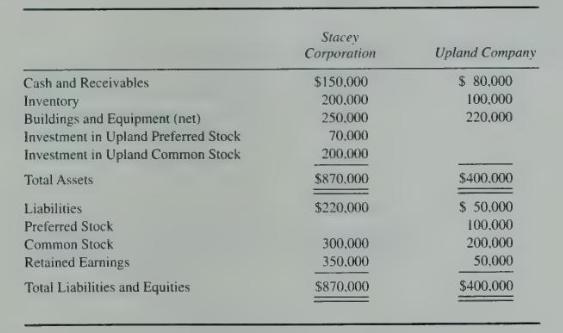

Stacey Corporation owns 80 percent of the common shares and 70 percent of the preferred shares of Upland Company, all purchased at underlying book value on January 1, 20X2. The balance sheets of Stacey Corporation and Upland Company immediately after the acquisition contained the following balances:

The preferred stock issued by Upland Company pays a 10 percent dividend and is cumulative. For 20X2 Upland Company reports net income of \(\$ 30,000\) and pays no dividends. Stacey Corporation reports income from its separate operations of \(\$ 100,000\) and pays dividends of \(\$ 40,000\) during \(20 \times 2\).

\section*{Required}

Select the correct answer for each of the following questions.

1. Total noncontrolling interest reported in the consolidated balance sheet as of January 1, 20X2, is:

a. \(\$ 30,000\).

b. \(\$ 50,000\).

c. \(\$ 70,000\).

d. \(\$ 80,000\).

2. Income assigned to the noncontrolling interest in the \(20 \times 2\) consolidated income statement is:

a. \(\$ 6,000\).

b. \(\$ 7,000\).

c. \(\$ 9,000\).

d. \(\$ 14,000\).

3. Consolidated net income for \(20 \times 2\) is:

a. \(\$ 116,000\).

b. \(\$ 123,000\).

c. \(\$ 124,000\)

d. \(\$ 130,000\).

4. Excluding the noncontrolling interest, total stockholders' equity reported in the consolidated balance sheet as of January 1, 20X2, is:

a. \(\$ 650,000\)

b. \(\$ 750,000\).

c. \(\$ 850,000\).

d. \(\$ 900,000\).

5. Preferred stock outstanding reported in the consolidated balance sheet as of January 1, 20X2, is:

a. \(\$ 0\).

b. \(\$ 30,000\).

c. \(\$ 70,000\).

d. \(\$ 100,000\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King