Sumo Pte Ltd initiated a share exchange agreement with Trim Ltd, a publicly listed company, whereby Trim

Question:

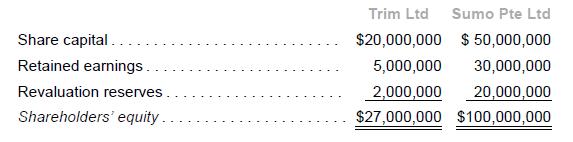

Sumo Pte Ltd initiated a share exchange agreement with Trim Ltd, a publicly listed company, whereby Trim Ltd would issue 16 million new ordinary shares in exchange for 100% ownership of Sumo Pte Ltd. On 1 July 20x1, all parties to the agreement executed the share exchange. The shareholders’ equity of Trim and Sumo on 1 July 20x1 were as follows:

The number of ordinary shares before the share exchange and the fair value per ordinary share of Trim Ltd and Sumo Pte Ltd are shown below:

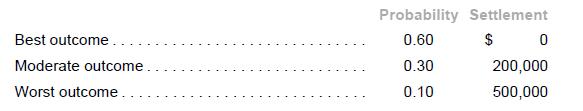

(a) Provision for loss under a guarantee: During 20x0, Trim Ltd sold land to a customer and gave a special guarantee to refund the customer the difference between the market value of the land on 1 July 20x4 and the original sales price. The following outcomes are deemed reliable:

Trim Ltd did not recognize the provision on its separate financial statements because the provision was deemed as not “probable.”

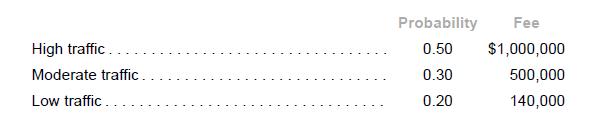

(b) Rights under a License: Trim Ltd has a non-transferable license to operate a toll booth at a bridge crossing.

Trim Ltd collects toll fees for the government and retains a portion as fee for managing the booth. The license fee has a remaining useful life of three years from 1 July 20x1. The expected annual fee income of Trim Ltd are as follows:

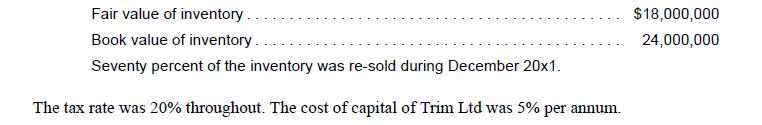

(c) Undervaluation of inventory: As at 1 July 20x1, the book value of Sumo’s identifiable net assets was close to fair value with the exception of the following:

Required

1. Assuming that the share exchange was in effect a reverse takeover (RTO), use the fair value of the acquirer’s shares to determine the fair value of consideration transferred by Sumo.

2. Assuming an RTO scenario, determine the goodwill acquired in accordance with IFRS 3.

3. In July 20x4, a final settlement of $200,000 was made under the guarantee.

(a) Show the entry to record the final settlement in Trim’s books (no record had been made previously for the guarantee).

(b) Show the entry that would have been passed for the final settlement in the acquirer’s books (although the economic entity does not have records, hypothetically assume that the books are kept).

(c) Show the consolidation adjustment to bring the entry in (a) to the entry in (b).

4. On 30 June 20x2, Trim Ltd revised its fee income under the high traffic scenario to $800,000. Explain how the acquirer should account for the following in its economic entity financial statements (with calculations) with respect to the license fee in 20x2 under each of the following situations:

(a) The revision arose because of a failure to use information that was available as at acquisition date.

(b) The revision arose because of new information on traffic conditions after acquisition date.

5. Assuming that the share exchange was not a RTO and that the fair value of Trim’s shares are reliably measurable, calculate the goodwill acquired in accordance with IFRS 3.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah