Taylor Corporation exchanged shares of its ($ 2) par common stock for all of the assets and

Question:

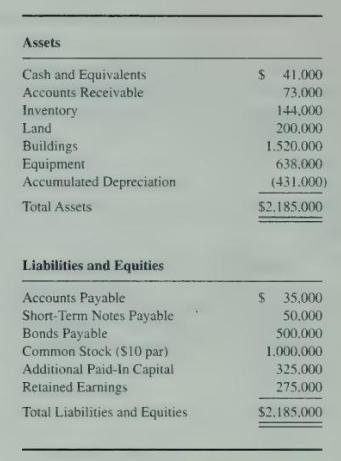

Taylor Corporation exchanged shares of its \(\$ 2\) par common stock for all of the assets and liabilities of Mark Company in a planned merger. Immediately prior to the combination, Mark's assets and liabilities were as follows:

Immediately prior to the combination. Taylor reported additional paid-in capital of \(\$ 250,000\) and retained earnings of \(\$ 1,350,000\). The fair values of Mark's assets and liabilities were equal to their book values on the date of combination except that Mark's buildings were worth \(\$ 1,500,000\) and its equipment was worth \(\$ 300,000\). Costs associated with planning and completing the business combination totaled \(\$ 38.000\), and stock issue costs totaled \(\$ 22.000\). The market value of Taylor's stock at the date of combination was \(\$ 4\) per share.

\section*{Required}

Prepare the journal entries that would appear on Taylor's books to record the combination under purchase accounting if Taylor issued the following number of shares in the combination:

a. 400,000 shares.

b. 900.000 shares.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King