The Carlos, Dan, and Gail (CDG) Partnership has decided to liquidate as of December 1, 20X6. A

Question:

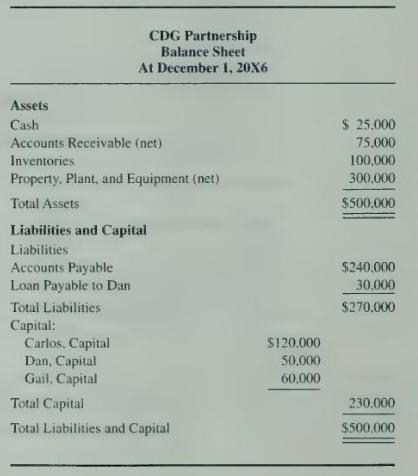

The Carlos, Dan, and Gail (CDG) Partnership has decided to liquidate as of December 1, 20X6. A balance sheet as of December 1, 20X6, appears below:

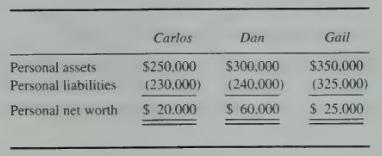

1. The personal assets (excluding partnership capital and loan interests) and personal liabilities of each partner as of December 1, 20X6, are presented below:

2. Carlos, Dan, and Gail share profits and losses in the ratio 20:40:40, respectively.

3. According to the partnership agreement, interest does not accrue on partners' loan balances during the liquidation process.

4. All of the noncash assets were sold on December 10, 20X6, for \(\$ 260,000\).

Required

a. Prepare a statement of realization and liquidation for the CDG Partnership on December 10 , 20X6.

b. Prepare a schedule showing how the partners' personal assets are to be distributed according to the provisions of the Uniform Partnership Act.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King