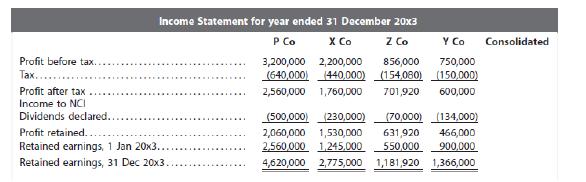

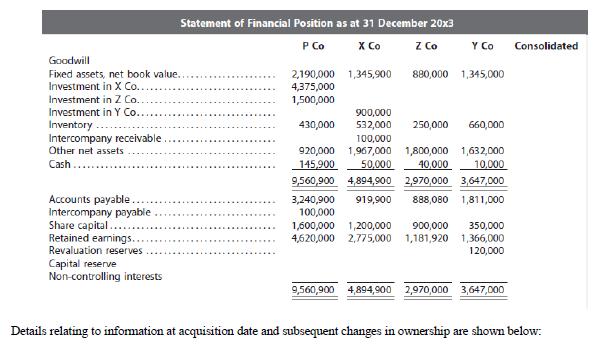

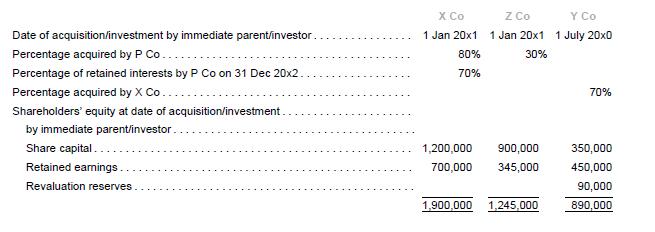

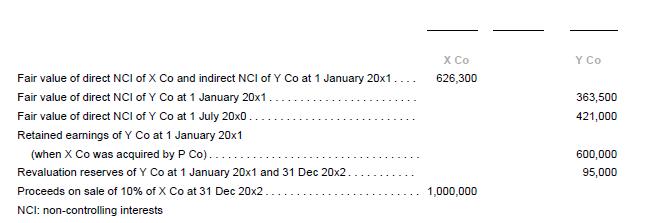

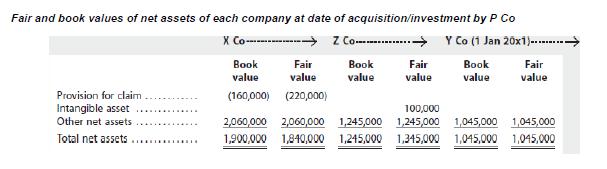

The financial statements of P Co and its subsidiaries and associate show below: Additional information 1. During

Question:

The financial statements of P Co and its subsidiaries and associate show below:

Additional information

1. During 20x2, X Co recognized a litigation settlement of $200,000 in respect of the provision for claims on an award of damages to the plaintiff by the courts. The case is still pending the final outcome following appeal by the plaintiff for a higher award of damages.

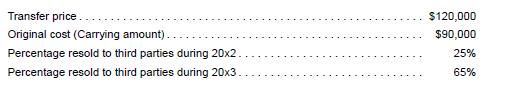

2. During August 20x2, Y Co sold excess inventory to P Co as follows:

3. Intangible assets of Z Co had a remaining lease term of 5 years from date of acquisition.

4. The fair value of net assets of Y Co was close to its book value when acquired by X Co and P Co.

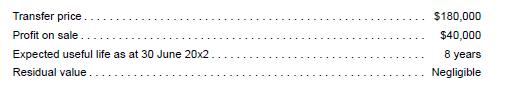

5. On 1 July 20x2, Z Co sold machinery to Y Co as follows:

6. Apply a tax rate of 20% on all appropriate adjustments. Recognize tax effects on fair value adjustments. Companies recognize impairment losses, if any, at the financial year-end.

Requirement

Prepare the consolidated financial statements for the year ended 31 December 20x3 using the end-result approach through workings (i.e., analytically derive the balances without having to formulate the consolidation and equity accounting entries and worksheets).

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah