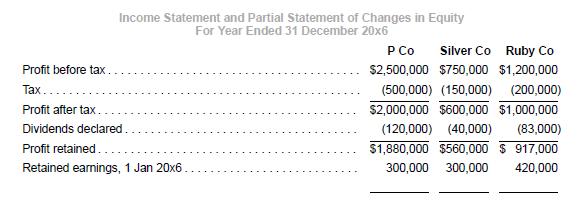

The financial statements of P Co, its subsidiary Silver Co, and its associate Ruby Co for the

Question:

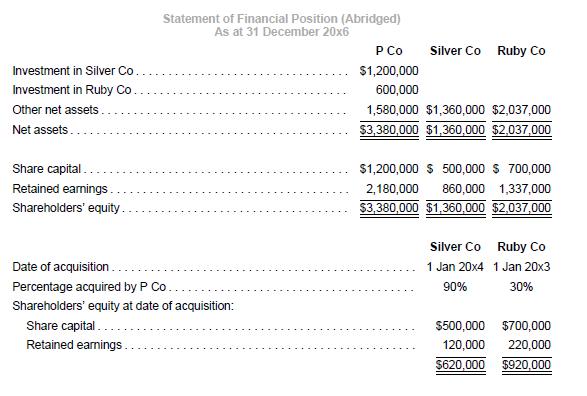

The financial statements of P Co, its subsidiary Silver Co, and its associate Ruby Co for the current year ended 31 December 20x6 are shown below.

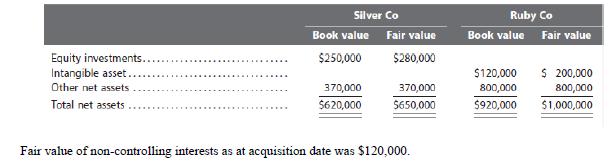

Fair and book values of identifiable net assets of each company at date of acquisition:

Additional information relating to Silver:

(a) Sixty percent of the undervalued equity investments were sold on 1 July 20x6 for $160,000. The remaining 40% had a fair value of $105,000 as at 31 December 20x6. The investments are carried at fair value through profit or loss at the group level. However, the unquoted equity investments were carried at cost in Silver’s books. It was only in 20x6 that Silver changed its accounting policy to carry the instruments at fair value through profit or loss.

(b) On 1 January 20x5, Silver Co transferred excess equipment to P Co at the invoiced price of $120,000 when the net book value of the equipment was $148,000. The fair value of the equipment at the date of transfer was $130,000. Original cost was $370,000. The original useful life was five years and the remaining useful life as at 1 January 20x5 was two years. Residual value was negligible.

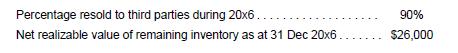

(c) During July 20x6, P Co sold inventory to Silver Co at the transfer price of $320,000 at a profit of $20,000.

Subsequently:

(d) As at 31 December 20x6, Silver Co owed P Co $200,000.

Additional information relating to Ruby:

(e) Intangible asset of Ruby Co had an infinite useful life. The cost model is used by Ruby Co and P Co.

Subsequently, impairment reviews revealed the following:

![]()

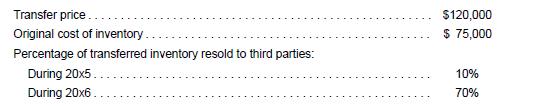

(f) During November 20x5, P Co sold inventory to Ruby as follows:

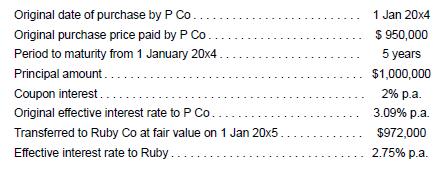

(g) On 1 January 20x5, P Co sold privately traded bonds to Ruby Co. P Co and the group classify these instruments as “loans and receivables” and use the amortized cost basis to measure the bonds.

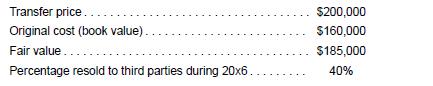

(h) On 9 October 20x6, Ruby Co sold inventory to P Co as follows:

![]()

(i) As at 31 December 20x6, Ruby Co owed P Co an amount of $600,000.

(j) Tax rate for both companies is 20% throughout. Recognize tax on fair value over book value differentials.

Required

1. Prepare consolidation entries for P Co and the group for the year ended 31 December 20x6, with narratives (brief headers) and workings in accordance with IFRS 3 and IAS 27.

2. Perform an analytical check on the balance in non-controlling interests in Silver Co as at 31 December 20x6, showing the workings clearly.

3. Prepare equity accounting entries to show P Co’s interest in Ruby Co for the year ended 31 December 20x6, with narratives (brief headers) and workings in accordance with IAS 28.

4. Perform an analytical check on the balance in investment in Ruby Co as at 31 December 20x6, showing the workings clearly.

5. Reconcile the net assets of P Co’s group as at 31 December 20x6 as follows:

(a) Method 1: Worksheet or Listing approach — list your CJE and EAJ that have an impact on net assets, and add them to the legal entity net assets of P Co and Silver Co.

(b) Method 2: Analytical approach — remove or add only the year-end adjustments to the legal entity net assets of P Co and Silver Co to arrive at the economic entity net assets, as derived in Method 1.

6. Perform an analytical check on consolidated retained earnings as at 31 December 20x6, showing workings clearly.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah