The following are the (20 mathrm{X} 2) transactions of the Midwest Heart Association, which has the following

Question:

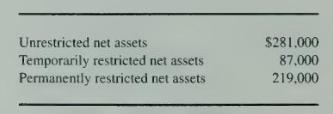

The following are the \(20 \mathrm{X} 2\) transactions of the Midwest Heart Association, which has the following funds and fund balances on January 1, 20X2:

1. Unrestricted pledges total \(\$ 700,000\), of which \(\$ 150,000\) are for \(20 \times 3\). Uncollectible pledges are estimated at 8 percent.

2. Restricted use grants total \(\$ 150,000\).

3. A total of \(\$ 520,000\) of current pledges are collected, and \(\$ 30,000\) of remaining uncollected current pledges are written off.

4. Office equipment is purchased for \(\$ 15,000\).

5. Unrestricted funds are used to pay the \(\$ 3,000\) mortgage payment due on the buildings.

6. Interest and dividends received are \(\$ 27,200\) on unrestricted investments and \(\$ 5,400\) on temporarily restricted investments. An endowment investment with a recorded value of \(\$ 5,000\) is sold for \(\$ 6,000\), resulting in a realized transaction gain of \(\$ 1,000\).

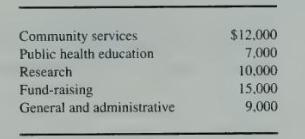

7. Depreciation is recorded and allocated as follows:

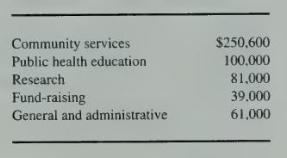

8. Other operating costs of the unrestricted current fund are:

9. Clerical services donated during the fund drive total \(\$ 2,400\). These are not part of the expenses reported in item 8 . It has been determined that these donated services should be recorded.

\section*{Required}

a. Prepare journal entries for the transactions in \(20 \mathrm{X} 2\).

b. Prepare a statement of activities for \(20 \mathrm{X} 2\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King