The following events affected the financial statement of Jey City during 20X2: section*{Budgetary Activities} 1. Total general

Question:

The following events affected the financial statement of Jey City during 20X2:

\section*{Budgetary Activities}

1. Total general fund estimated revenues \(\$ 8,000,000\)

2. Total general fund estimated expenditures \(\$ 7,500,000\)

3. Planned construction of a courthouse improvement expected to cost \(\$ 1,500,000\) and to be financed in the following manner: \(\$ 250,000\) from the general fund, \(\$ 450,000\) from state entitlements, and \(\$ 800,000\) from the proceeds of 20 -year, 8 percent bonds dated and expected to be issued at par on June 30, 20X2. Interest on the bonds is payable annually on July 1, together with one-twentieth of the bond principal from general fund revenues of the payment period.

4. A budgeted general fund payment of \(\$ 180,000\) to subsidize operations of a solid waste landfill enterprise fund.

Actual results included the following:

5. Jey recorded property tax revenues of \(\$ 5,000,000\) and a related allowance for uncollectiblescurrent of \(\$ 60,000\). On December \(31,20 \times 2\), the remaining \(\$ 56,000\) balance of the allowance for uncollectibles-current was closed, and an adjusted allowance for uncollectibles-delinquent was recorded equal to the property tax receivables balance of \(\$ 38,000\).

6. A police car with an original cost of \(\$ 25.000\) was sold for \(\$ 7,000\).

7. Office equipment to be used by the city's fire department was acquired through a capital lease. The lease required 10 equal payments of \(\$ 10,000\) beginning with the July \(1,20 \times 2\), acquisition date. Using a 6 percent discount rate, the 10 payments had a present value of \(\$ 78,000\) at the acquisition date.

8. The courthouse was approved and financed as budgeted except for a \(\$ 27,000\) cost overrun that was paid for by the general fund. Jey plans to transfer cash to the debt service fund during 20X3 to service the interest and principal payments called for in the bonds.

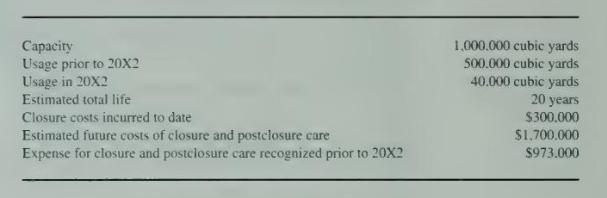

9. Information related to the solid waste landfill at December 31, 20X2:

\section*{Required}

For items 1 through 10, describe the amounts based solely on the preceding information.

1. What was the net effect of the budgetary activities on the general fund balance at January 1, 20X2?

2. What was the total amount of transfers out included in the general fund's budgetary accounts at January 1. 20X2?

3. What amount of interest payable related to the 20 -year bonds should be reported by the general fund at December 31, 20X2?

4. What lease payment amount should be included in \(20 \times 2\) general fund expenditures?

5. What amount was collected from \(20 \times 2\) property taxes in \(20 \times 2\) ?

6. What was the total amount of the capital project fund's \(20 \times 2\) revenues?

7. What amount should be reported as long-term liabilities in the governmental activities column of the government-wide financial statements at December 31, 20X2?

8. What total change in the balance of long-term assets, before depreciation, should be reported in the governmental activities column of the government-wide financial statements at December 31, 20X2?

9. What \(20 \times 2\) closure and postclosure care expenses should be reported in the solid waste landfill enterprise fund?

10. What should be the December \(31,20 \times 2\), closure and postclosure care liability reported in the solid waste landfill enterprise fund?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King