The Jackson. Jensen, and Johnson (JJJ) Partnership has decided to liquidate its operations as of December 31,

Question:

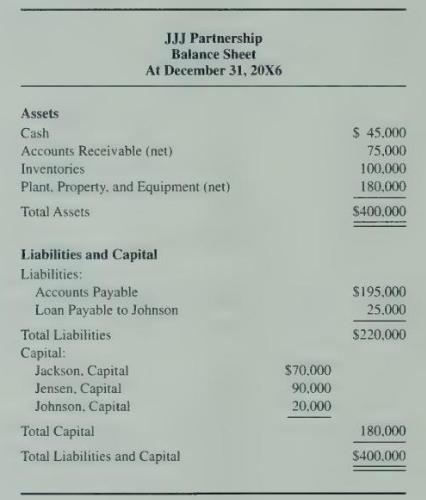

The Jackson. Jensen, and Johnson (JJJ) Partnership has decided to liquidate its operations as of December 31, 20X6. A balance sheet prepared at that date is presented as follows:

\section*{Required}

a. The JJJ Partnership wishes to know how cash will be distributed as it becomes available. Therefore, it wants you to prepare a cash distribution plan. Jackson, Jensen, and Johnson share profits and losses in the ratio 20:30:50, respectively. The partnership does not expect to incur any liquidation expenses.

b. The partners also want to know how much cash would have to be received from the sale of the noncash assets in order for Johnson to receive \(\$ 25,000\) of cash from the liquidation. Prepare a schedule that discloses this amount. Assume that the partnership agreement states that interest does not accrue on loans from partners during the liquidation process.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King