The Paraffin Supply Company Limited acquired freehold land as a depot for its delivery vans and started

Question:

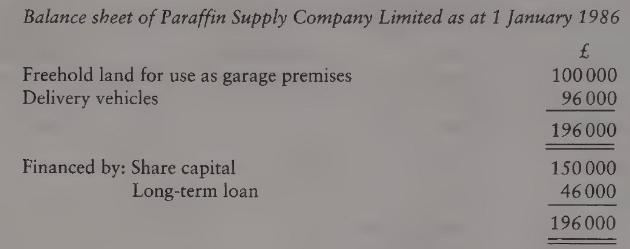

The Paraffin Supply Company Limited acquired freehold land as a depot for its delivery vans and started business on 1 January 1986. It collected sufficient paraffin from a wholesaler each day to satisfy known orders. The wholesaler was paid in cash and the customers paid cash on delivery. The opening balance sheet at 1 January 1986 showed the following:

The company traded for 2 years until 31 December 1987. All profits had been retained in the business. There were no creditors, debtors or stocks. At 31 December 1987 the directors were considering whether to cease trading at 31 December 1988.

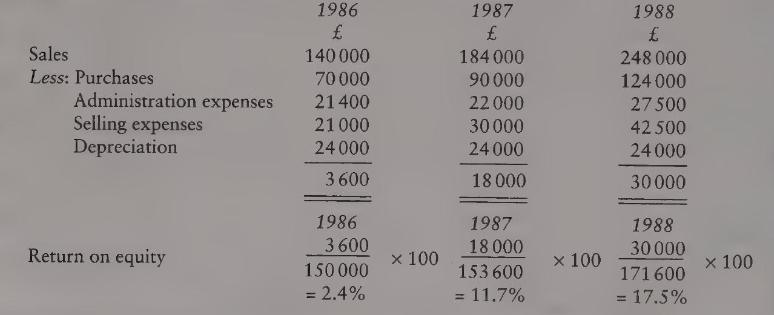

The accountant produced the following estimated accounts for the year ended 31 December 1988 with the 1986 and 1987 actual comparative figures:

Profit and loss accounts for the years ended 31 December

In preparing the accounts the following conventions and policies had been followed:

(a) The capital maintenance concept is that capital will be maintained if the cost of assets representing the initial monetary investment is recovered against operations.

(b) The concept of profit is that profit for the year is regarded as any gains arising during the year which may be distributed while maintaining the amount of the shareholders' interest in the company at the beginning of the year.

(c) The measurement unit used is the medium of exchange.

(d) Depreciation of delivery vans is over 4 years using the straight-line method.

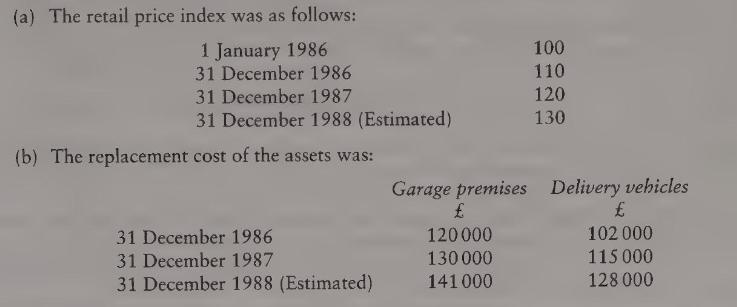

The directors had recently attended a seminar on the treatment of inflation in financial reports and they required the profits to be calculated using the general purchasing power income model and the replacement cost model.

The accountant obtained the following information to allow him to redraft the profit and loss account using these two models:

Required

(a) (i) Prepare the profit and loss account for the year ended 31 December 1988 using the general purchasing power income model and explain the following: The concept of capital maintenance used.

The concept of profit used.

The measurement unit used.

(ii) Mention four criteria for selecting an appropriate unit of measurement for financial reporting and briefly discuss whether the general purchasing power income model satisfies these criteria.

(8 marks)

(b) (i) Prepare the profit and loss account for the year ended 31 December 1988 using the replacement cost model to show reported income on the assumption that backlog depreciation is not deducted in arriving at this reported income and explain the following:

The concept of capital maintenance used.

The concept of profit used.

The measurement unit used.

(ii) Discuss the arguments for and against excluding backlog depreciation when calculating the reported income.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780273638339

6th Edition

Authors: Richard Lewis, David Pendrill