There are currently two possible methods of preparing consolidated financial statements when two or more separate legal

Question:

There are currently two possible methods of preparing consolidated financial statements when two or more separate legal entities combine to form a single economic entity in the form of a group. The most commonly used method is the acquisition method. However, another method is sometimes appropriate when two or more separate legal entities unite into one economic entity by means of an exchange of equity shares. This method is known as the merger method.

Recent developments suggest that Standard setters are considering a change that would prevent the merger method ever being used and require that the acquisition method be used to prepare consolidated financial statements following a business combination.

Top plc and Bottom plc are two listed companies that operate in the same sector. The two sets of directors have been speculating for some time that it would be in the mutual interest of the two companies to combine together to form a single economic entity while maintaining the separate legal status of the two companies. Accordingly, on 30 April 2001 Top plc made an offer to all the equity shareholders of Bottom plc to acquire their shares. The terms of the offer were 4 equity shares in Top plc for every 3 equity shares in Bottom plc. The offer was accepted by all the equity shareholders in Bottom plc and the exchange of equity shares took place on 31 May 2001. The directors of Top plc wish to use merger accounting to prepare the consolidated financial statements for the year ended 31 January 2002. Any computational work in this question should assume that merger accounting principles will be adopted.

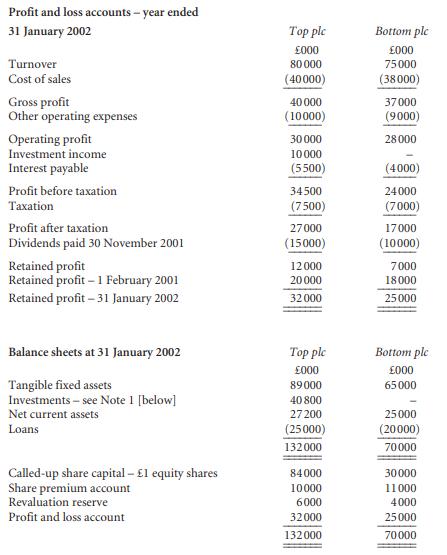

The relevant profit and loss accounts and balance sheets of Top plc and Bottom plc are given below:

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey