This problem consists of three parts concerning nongovernmental not-for-profit organizations. Part A consists of three items, Part

Question:

This problem consists of three parts concerning nongovernmental not-for-profit organizations. Part A consists of three items, Part B consists of six items, and Part \(\mathrm{C}\) consists of eight times.

\section*{Part A.}

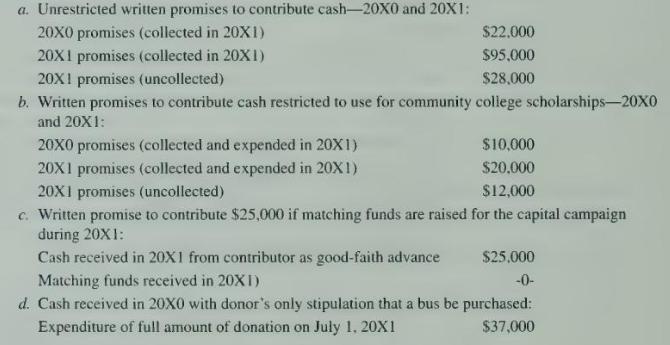

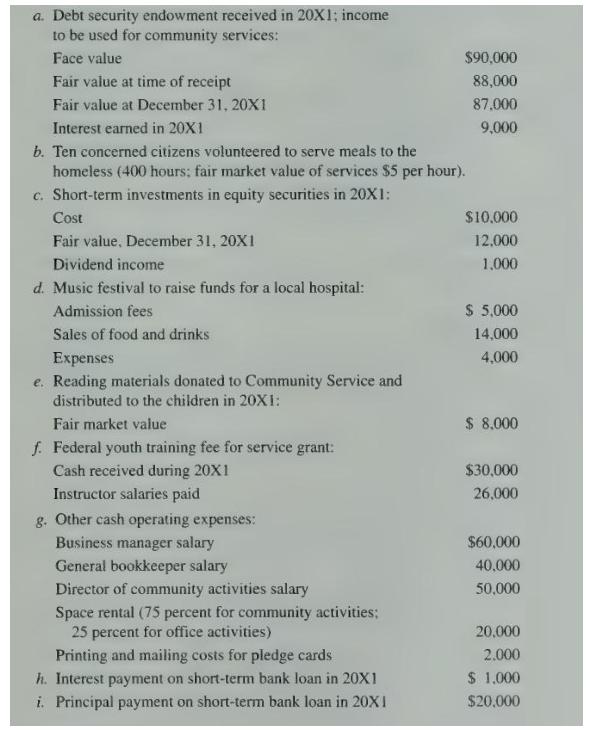

Community Service Inc. is a nongovernmental not-for-profit voluntary health and welfare calendaryear organization that began operations on January 1,20X0. It performs voluntary services and derives its revenue from the general public. Community Service Inc. implies a time restriction on all promises to contribute cash in future periods. However, no such policy exists with respect to gifts of long-lived assets.

Selected transactions occurred during Community Service's 20XI calendar year.

\section*{Required}

Items 1 through 3 represent the \(20 \mathrm{X} 1\) amounts that Community Service reported for selected financial statement elements in its December 31, 20X1, statement of financial position, and 20X1 statement of activities. For each item, indicate whether the amount was overstated, understated, or correctly stated. Select your answer from the list below. An answer may be selected once, more than once, or not at all.

\section*{List}

O Overstated U Understated C Correctly stated 1. Community Service reported \(\$ 28,000\) as contributions receivable.

2. Community Service reported \(\$ 37,000\) as net assets released from restrictions (satisfaction of use restrictions).

3. Community Service reported \(\$ 22,000\) as net assets released from restrictions (due to the lapse of time restrictions).

\section*{Part B.}

Community Service Inc. is a nongovermmental not-for-profit voluntary health and welfare calendaryear organization that began operations on January 1, 20X0. It performs voluntary services and derives its revenue from the general public. Community Service Inc. implies a time restriction on all promises to contribute cash in future periods. However, no such policy exists with respect to gifts of long-lived assets.

Selected transactions occurred during Community Service's 20X1 calendar year.

\section*{Required}

For items 4 through 9 , determine the amounts for the following financial statements elements in the 20X1 statement of activities. Select your answer from the following list of amounts. An amount may be selected once, more than once, or not at all.

A. \(\$ 0\)

B. \(\$ 2,000\)

C. \(\$ 3.000\)

D. \(\$ 5,000\)

E. \(\$ 8,000\)

F. \(\$ 9,000\)

G. \(\$ 14,000\)

H. \(\$ 16,000\)

I. \(\$ 26,000\)

J. \(\$ 50,000\)

K. \(\$ 87,000\)

L. \(\$ 88,000\)

M. \(\$ 90,000\)

N. \(\$ 94,000\)

O. \(\$ 99,000\)

4. Contributions-permanently restricted.

5. Revenues-fees.

6. Program expenses.

7. General fund-raising expenses (excludes special events).

8. Income on long-term investments (unrestricted).

9. Contributed voluntary services.

\section*{Part C.}

Items 10 through 17 are based on the fact pattern and financial information found in both Part A and Part B.

\section*{Required}

Items 10 through 17 represent Community Service's transactions reportable in the statement of cash flows. For each of the items listed, select the classification that best described the item. A classification may be selected once, more than once, or not at all.

\section*{Classifications}

O Cash flows from operating activities.

I Cash flows from investing activities.

F Cash flows from financing activities.

10. Unrestricted 20X0 promises collected.

11. Cash received from a contributor as a good-faith advance on a promise to contribute matching funds.

12. Purchase of bus.

13. Principal payment on short-term bank loan.

14. Purchase of equity securities.

15. Dividend income earned on equity securities 16. Interest payment on short-term bank loan.

17. Interest earned on endowment.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King