Thorne Corporation purchased controlling ownership of Skyler Corporation on December 31, 20X3, and a consolidated balance sheet

Question:

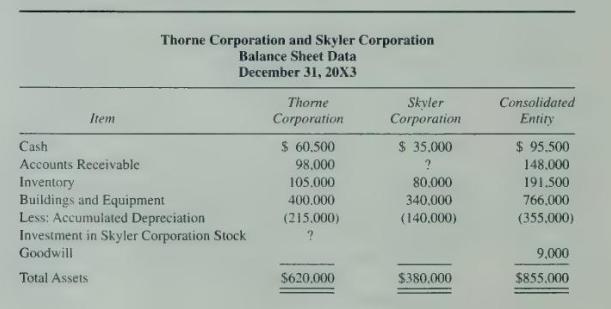

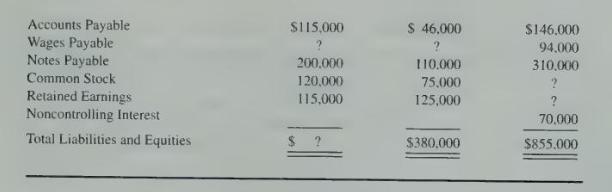

Thorne Corporation purchased controlling ownership of Skyler Corporation on December 31, 20X3, and a consolidated balance sheet was prepared immediately. Partial balance sheet data for the two companies and the consolidated entity at the date were:

During 20X3, Thorne provided engineering services to Skyler and has not yet been paid for the services. There were no other receivables or payables between Thorne and Skyler at December 31, 20X3.

Required

a. What is the amount of unpaid engineering services at December \(31,20 \times 3\), on work done by Thorne for Skyler?

b. What balance in accounts receivable did Skyler report at December 31, 20X3?

c. What amounts of wages payable did Thorne and Skyler report at December 31, 20X3?

d. What percentage of Skyler's shares were purchased by Thorne?

e. What amounts of capital stock and retained earnings must be reported in the consolidated balance sheet?

f. What amount did Thorne pay to acquire the Skyler shares?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King