Use the preceding information for Purnells purchase of Sentinel common stock. Assume Purnell exchanges 10,000 shares of

Question:

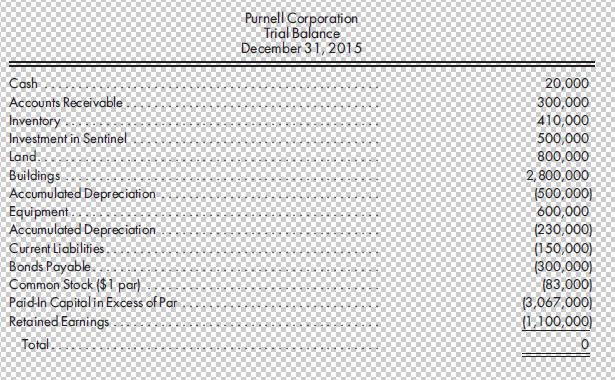

Use the preceding information for Purnell’s purchase of Sentinel common stock. Assume Purnell exchanges 10,000 shares of its own stock for 80% of the common stock of Sentinel. The stock has a market value of $50 per share and a par value of $1. Purnell has the following trial balance immediately after the purchase:

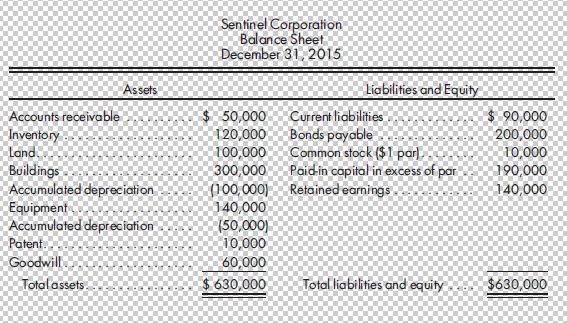

Purnell Corporation acquires Sentinel Corporation on December 31, 2015. Sentinel has the following balance sheet on the date of acquisition:

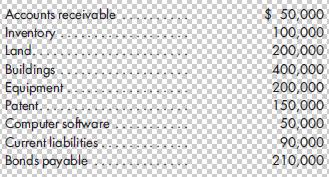

An appraisal is performed to determine whether the book values of Sentinel’s net assets reflect their fair values. The appraiser also determines that intangible assets exist, although they are not recorded. The following fair values for assets and liabilities are agreed upon:

Required

1. Prepare the value analysis schedule and the determination and distribution of excess schedule for the investment in Sentinel.

2. Complete a consolidated worksheet for Purnell Corporation and its subsidiary Sentinel Corporation as of December 31, 2015.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1305084858

12th edition

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng