Using the data presented in E5-5, prepare a solution assuming the business combination occurred prior to the

Question:

Using the data presented in E5-5, prepare a solution assuming the business combination occurred prior to the effective date of FASB 141R.

E5-5,

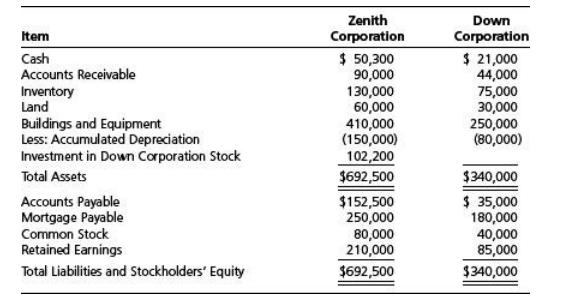

Power Company owns 90 percent of Pleasantdale Dairy's stock. The balance sheets of the two companies immediately after the Pleasantdale acquisition showed the following amounts:

The fair value of the noncontrolling interest at the date of acquisition was determined to be $30,000. The full amount of the increase over book value is assigned to land held by Pleasantdale. At the date of acquisition, Pleasantdale owed Power $8,000 plus $900 accrued interest. Pleasantdale had recorded the accrued interest, but Power had not.

Required

Prepare and complete a consolidated balance sheet workpaper.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0073526911

8th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey