Water Company owns 80 percent of the outstanding common stock of Fire Company. On December 31, 20X9,

Question:

Water Company owns 80 percent of the outstanding common stock of Fire Company. On December 31, 20X9, Fire sold equipment to Water at a price in excess of Fire's carrying amount, but less than its original cost. On a consolidated balance sheet at December 31, 20X9, the carrying amount of the equipment should be reported at:

a. Water's original cost.

b. Fire's original cost.

c. Water's original cost less Fire's recorded gain.

d. Water's original cost less 80 percent of Fire's recorded gain.

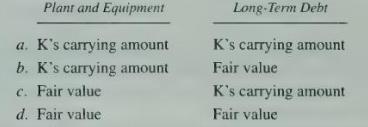

2. Company \(\mathrm{J}\) acquired all of the outstanding common stock of Company \(\mathrm{K}\) in exchange for cash. The acquisition price exceeds the fair value of net assets acquired. How should Company J determine the amounts to be reported for the plant and equipment and long-term debt acquired from Company K?

3. Port Inc. owns 100 percent of Salem Inc. On January 1, 20X2, Port sold Salem delivery equipment at a gain. Port had owned the equipment for two years and used a five-year straightline depreciation rate with no residual value. Salem is using a three-year straight-line depreciation rate with no residual value for the equipment. In the consolidated income statement, Salem's recorded depreciation expense on the equipment for \(20 \times 2\) will be decreased by:

a. 20 percent of the gain on the sale.

b. \(331 / 3\) percent of the gain on the sale.

c. 50 percent of the gain on the sale.

d. 100 percent of the gain on the sale.

4. On January 1, 20X0, Poe Corporation sold a machine for \(\$ 900,000\) to Saxe Corporation, its wholly owned subsidiary. Poe paid \(\$ 1,100,000\) for this machine, which had accumulated depreciation of \(\$ 250,000\). Poe estimated a \(\$ 100,000\) salvage value and depreciated the machine on the straight-line method over 20 years, a policy which Saxe continued. In Poe's December \(31,20 \mathrm{X} 0\), consolidated balance sheet, this machine should be included in cost and accumulated depreciation as:

5. Scroll Inc., a wholly owned subsidiary of Pirn Inc., began operations on January 1, 20X1. The following information is from the condensed 20X1 income statements of Pirn and Scroll:

Equipment purchased by Scroll from Pirn for \(\$ 36,000\) on January 1, 20X1, is depreciated using the straight-line method over four years. What amount should be reported as depreciation expense in Pirn's 20X1 consolidated income statement?

a. \(\$ 50,000\).

b. \(\$ 47,000\).

c. \(\$ 44,000\).

d. \(\$ 41,000\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King